For the 24 hours to 23:00 GMT, the EUR declined 0.99% against the USD and closed at 1.1408 on Friday.

The US dollar gained ground against the major currencies, after the US President, Donald Trump imposed double tariffs on Turkey’s steel and aluminium imports.

In the US, data indicated that the US consumer price index (CPI) advanced 2.9% on an annual basis in July, at par with market expectations. The CPI had registered a similar rise in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.1379, with the EUR trading 0.25% lower against the USD from Friday’s close.

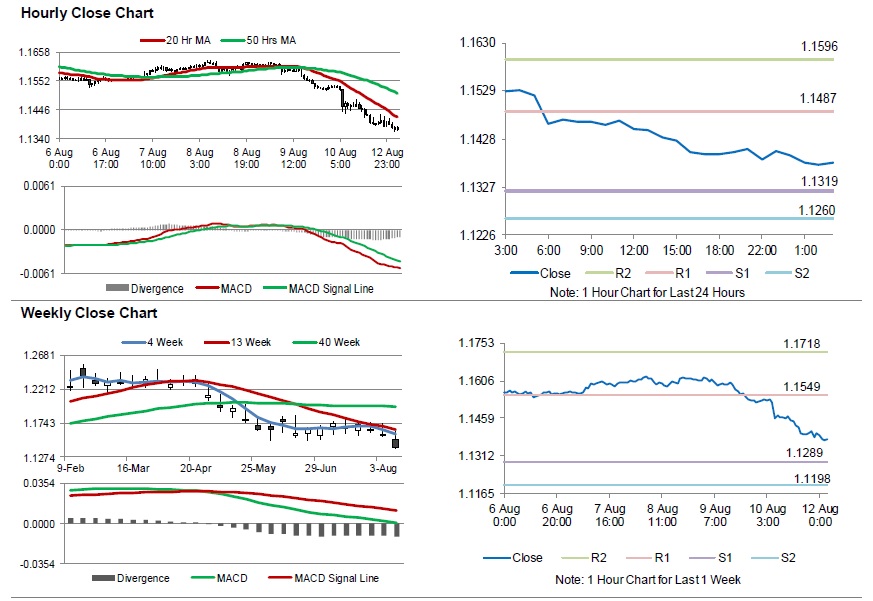

The pair is expected to find support at 1.1319, and a fall through could take it to the next support level of 1.1260. The pair is expected to find its first resistance at 1.1487, and a rise through could take it to the next resistance level of 1.1596.

With no macroeconomic releases in the Euro-zone and the US today, investors would look forward to global macroeconomic events for further direction.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.