For the 24 hours to 23:00 GMT, the GBP declined 0.42% against the USD and closed at 1.2769 on Friday.

On the data front, Britain’s preliminary gross domestic product (GDP) climbed 0.4% on a quarterly basis in 2Q 2018, driven by robust retail sales and good weather conditions and in line with market consensus. In the prior quarter, the GDP rose 0.2%. Moreover, the nation’s total trade deficit narrowed to £1.9 billion in June, from a revised deficit of £3.1 billion in the previous month. Market participants had expected the deficit to narrow to £2.5 billion.

Other data showed that, UK’s industrial production rebounded 0.4% on a monthly basis in June, recording its first rise in four months and compared to a revised drop of 0.2% in the prior month. Markets had envisaged industrial production to rise 0.3%. Also, the nation’s manufacturing production advanced 0.4% on a monthly basis in June, higher than market expectations for a rise of 0.3%. In the prior month, manufacturing production had registered a revised rise of 0.6%. Moreover, construction output unexpectedly rose 1.4% on a monthly basis in June. In the previous month, construction output had risen 2.9%.

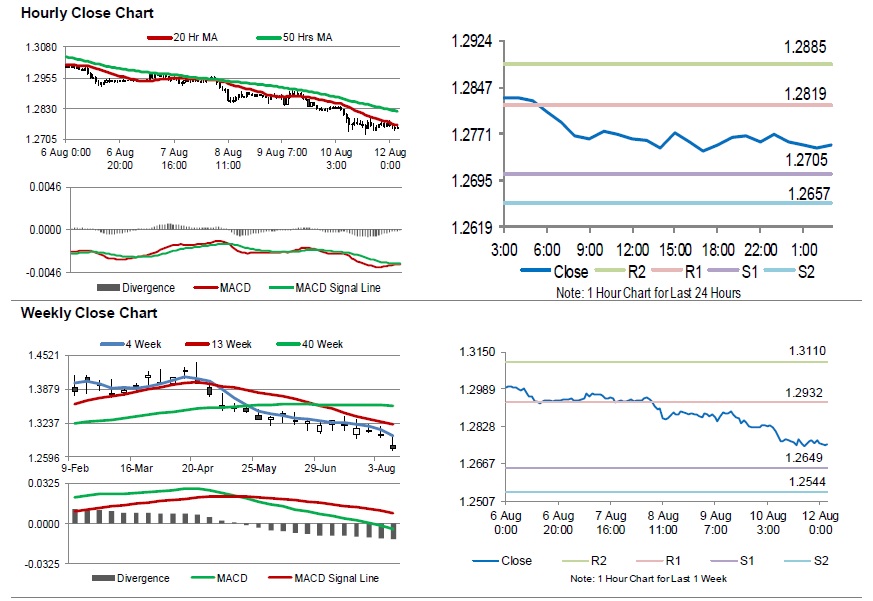

In the Asian session, at GMT0300, the pair is trading at 1.2753, with the GBP trading 0.13% lower against the USD from Friday’s close.

The pair is expected to find support at 1.2705, and a fall through could take it to the next support level of 1.2657. The pair is expected to find its first resistance at 1.2819, and a rise through could take it to the next resistance level of 1.2885.

In absence of key economic releases in the UK today, investor sentiment would be determined by global macroeconomic events.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.