For the 24 hours to 23:00 GMT, the EUR rose 0.58% against the USD and closed at 1.1410, following positive ZEW economic survey data in the Euro-zone and Germany.

Data showed that Germany’s ZEW economic sentiment index jumped to a 12-month high level of 53.0 in February, compared to prior month’s reading of 48.4. Additionally, the nation’s ZEW current situation index advanced more than anticipated to a reading of 45.5 in February.

The Euro was further supported, after the Euro-zone’s ZEW economic sentiment index improved to 52.70 in February, compared to a reading of 45.20 in the previous month.

In the US, the NAHB housing market index dropped unexpectedly to 55.00 in February, compared to a level of 57.00 in the previous month. Market expectations were for the index to climb to a level of 58.00. Additionally, the NY Empire State manufacturing index registered a drop to a level of 7.78 in February, more than market expectations of a fall to 8.50.

Separately, the Cleveland Fed President, Loretta Mester urged the Fed to drop its pledge to be “patient” before making an interest rate hike move and hinted that the US central bank should raise its benchmark rate by the middle of this year.

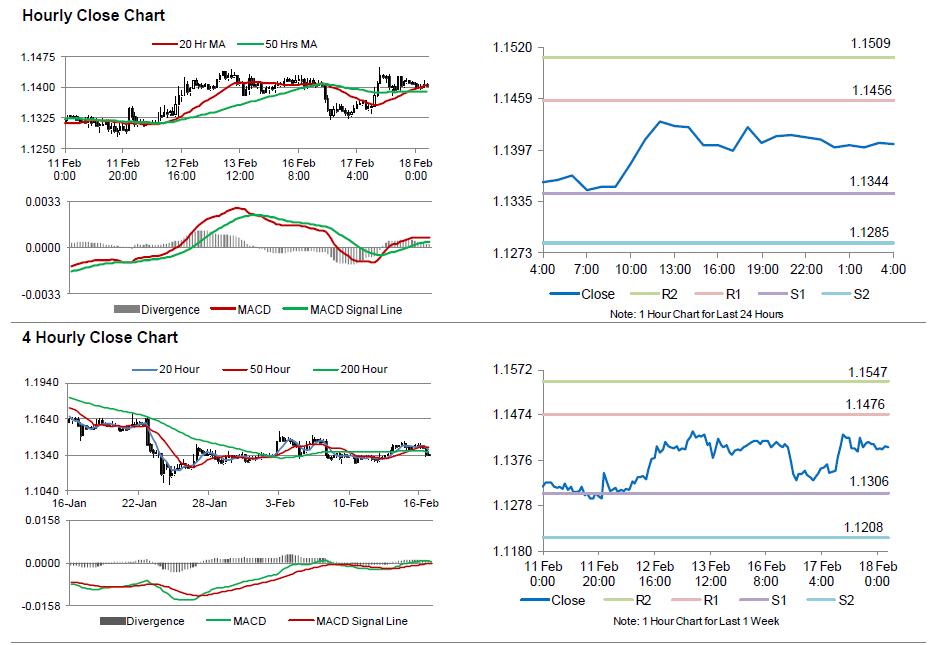

In the Asian session, at GMT0400, the pair is trading at 1.1404, with the EUR trading 0.06% lower from yesterday’s close.

The pair is expected to find support at 1.1344, and a fall through could take it to the next support level of 1.1285. The pair is expected to find its first resistance at 1.1456, and a rise through could take it to the next resistance level of 1.1509.

Amid a light economic calendar in the Euro-zone and its peripheries today, trading trends in the pair would be determined by the release of the Fed minutes, scheduled later today.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.