For the 24 hours to 23:00 GMT, the GBP traded a tad lower against the USD and closed at 1.5352, following worse than expected inflation data in the UK.

Britain’s consumer prices eased more than expected by 0.9% on a monthly basis in January, against a 0.8% expected fall. The consumer price index had registered an unchanged reading in the prior month. The dip in consumer prices affirmed last week’s comment from the BoE Governor, Mark Carney that the UK inflation would probably soon slide below zero due to tumbling oil prices. However, the BoE also indicated that inflation will rebound to notch its 2% target in about two year’s time.

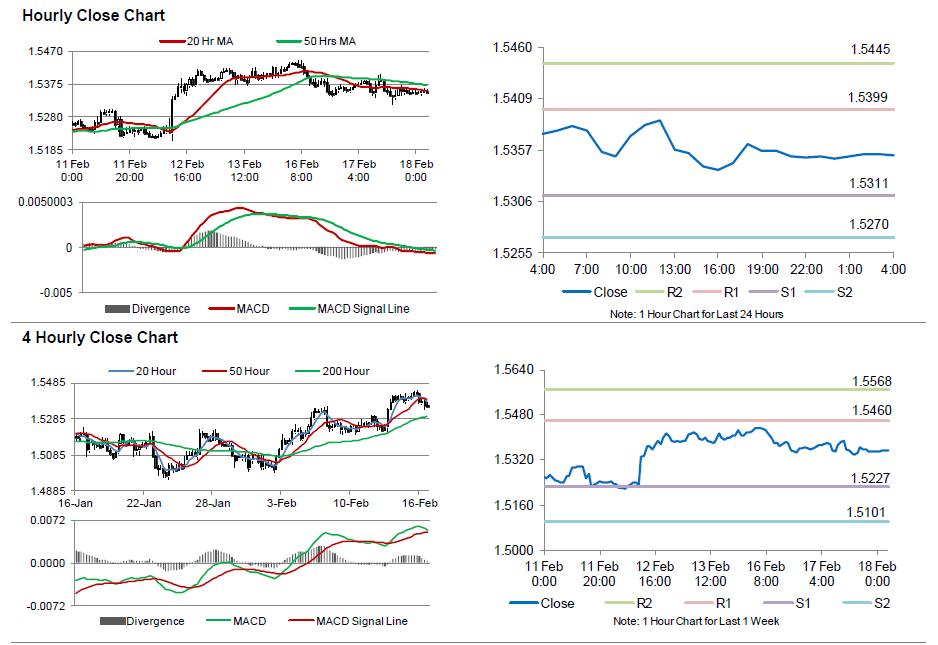

In the Asian session, at GMT0400, the pair is trading at 1.5353, with the GBP trading a tad higher from yesterday’s close.

The pair is expected to find support at 1.5311, and a fall through could take it to the next support level of 1.527. The pair is expected to find its first resistance at 1.5399, and a rise through could take it to the next resistance level of 1.5445.

Trading trends in the Pound today are expected to be determined by Britain’s ILO unemployment rate data coupled with the BoE minutes, scheduled in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.