For the 24 hours to 23:00 GMT, the EUR slightly rose against the USD and closed at 1.1765.

In economic news, French industrial production dropped more-than-expected by 1.1% on a monthly basis in June, dropping by the most in four months and compared to market expectations for a fall of 0.6%. Industrial production had climbed 1.9% in the previous month.

Macroeconomic data indicated that the number of Americans filing for jobless claims for the first time unexpectedly rose to a level of 244.0K in the week ended 05 August 2017, confounding market consensus for a fall to a level of 240.0K. In the previous week, initial jobless claims had recorded a revised level of 241.0K. Additionally, the nation’s producer price index (PPI) surprisingly fell 0.1% on a monthly basis in July, hitting its lowest in nearly a year. The PPI had advanced 0.1% in the previous month, while markets were anticipating for a rise of 0.1%.

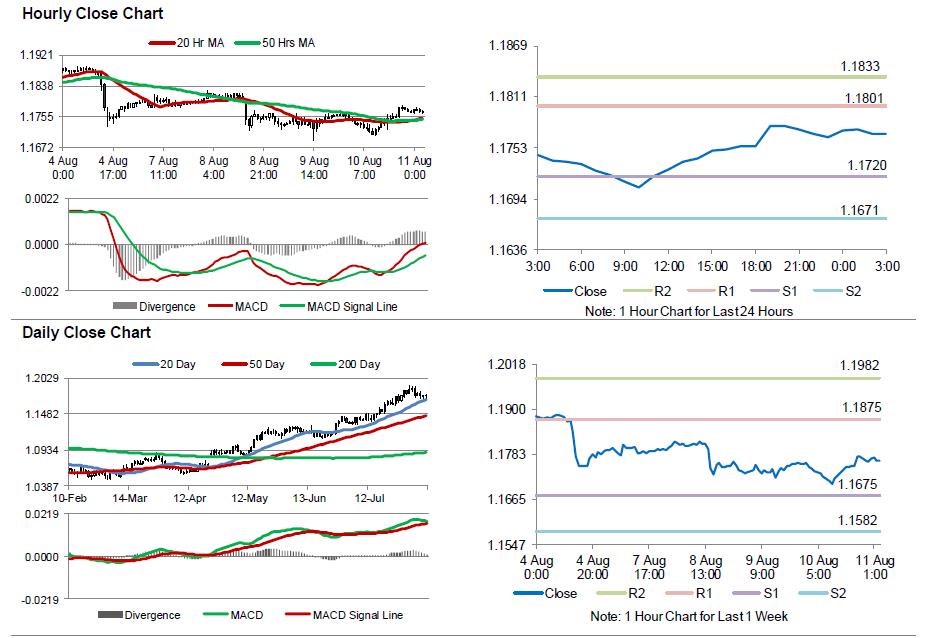

In the Asian session, at GMT0300, the pair is trading at 1.1768, with the EUR trading a tad higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1720, and a fall through could take it to the next support level of 1.1671. The pair is expected to find its first resistance at 1.1801, and a rise through could take it to the next resistance level of 1.1833.

Going ahead, traders will closely monitor Germany’s final consumer price inflation for July, slated to release in a few hours. Also, the US inflation report for July, slated to release later in the day, will pique significant amount of investor attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.