For the 24 hours to 23:00 GMT, the GBP declined 0.26% against the USD and closed at 1.2976, following disappointing economic data in the UK.

Data indicated that Britain’s total trade deficit surprisingly widened to a nine-month high level of £4.56 billion in June, as exports dipped and imports surged. The nation had posted a revised deficit of £2.52 billion in the previous month, whereas market participants had envisaged for a deficit of £2.50 billion. Further, the nation’s construction output recorded an unexpected drop of 0.1% on a monthly basis in June, compared to a revised fall of 0.4% in the prior month, while market participants had anticipated for a gain of 1.4%. Further, NIESR estimated UK’s gross domestic product (GDP) climbed less-than-anticipated by 0.2% in the three months to July, compared to market expectations for a rise of 0.3%. In the April-June 2017 period, NIESR estimated GDP had climbed 0.3%.

In other economic news, manufacturing production in the UK remained flat on a monthly basis in June, at par with market expectations. In the prior month, manufacturing production had recorded a revised drop of 0.1%. On the other hand, the nation’s industrial production climbed 0.5% on a monthly basis in June, more than market consensus for an advance of 0.1%. Industrial production had registered a revised flat reading in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.2982, with the GBP trading 0.05% higher from yesterday’s close.

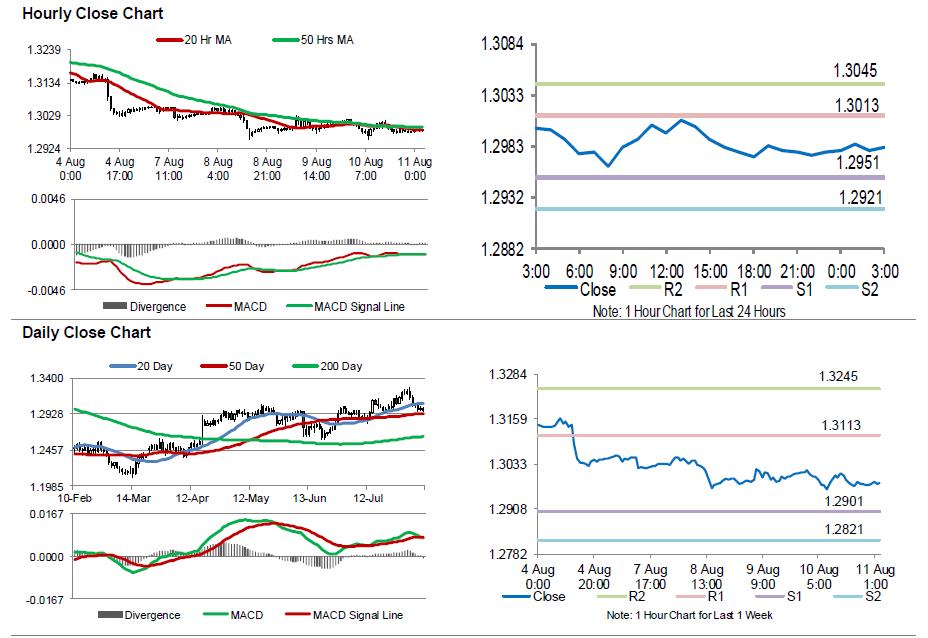

The pair is expected to find support at 1.2951, and a fall through could take it to the next support level of 1.2921. The pair is expected to find its first resistance at 1.3013, and a rise through could take it to the next resistance level of 1.3045.

Amid no macroeconomic releases in the UK today, investors will keep a close watch on UK’s inflation figures, retail sales and ILO unemployment rate data, all scheduled to release next week.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.