For the 24 hours to 23:00 GMT, the EUR rose 0.50% against the USD and closed at 1.0967, on the back of stronger than expected IFO data in Germany.

Yesterday, data showed that Germany’s IFO business climate index rose for the fifth consecutive month to a reading of 107.9 in March, from previous month’s level of 106.8 and beating market expectations of a rise to a level of 107.3, suggesting that growth in the Euro-zone’s biggest economy rebounded again in the first quarter of 2015. Additionally, the nation’s IFO business expectation index improved more than expected to a level of 103.9 in March, higher than market expectations which projected a rise to a reading of 103.0. In the previous month, the index had registered a level of 102.5.

The greenback lost ground, after the US durable goods orders unexpectedly plunged 1.4% in February, compared to market expectations of an advance of 0.2% and following a revised rise of 2.0% registered in the preceding month. Meanwhile, MBA mortgage applications rose 9.5% in the week ended 20 March. It had dropped 3.9% in the preceding week.

Separately, the Chicago Fed president, Charles Evans, raised concerns about low inflation in the US. He further opined that the central bank should keep its interest rates low until 2016 as uncertainty continues to hover over the health of the global economy.

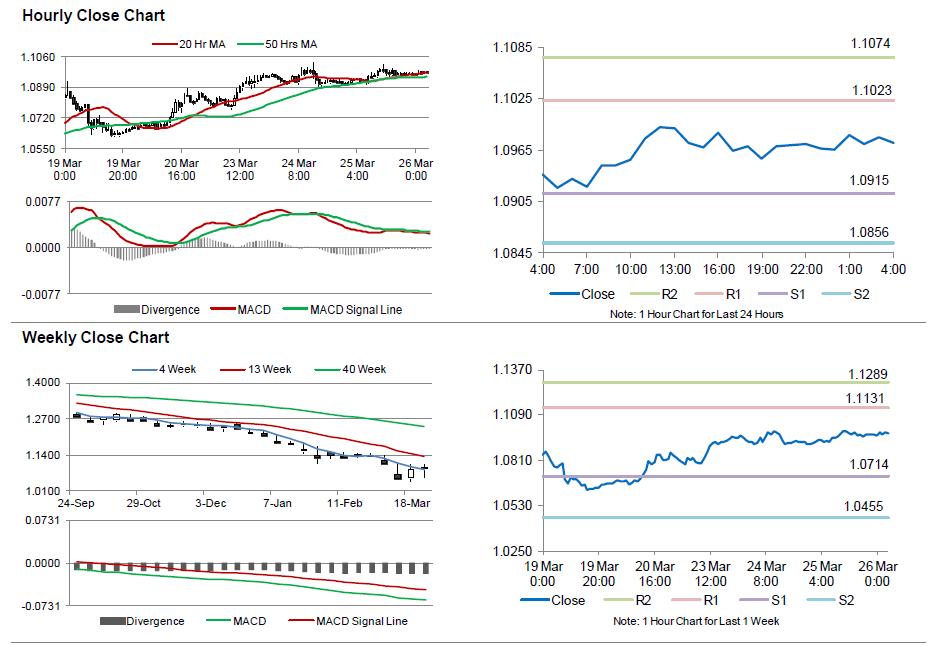

In the Asian session, at GMT0400, the pair is trading at 1.0973, with the EUR trading a tad higher from yesterday’s close.

The pair is expected to find support at 1.0915, and a fall through could take it to the next support level of 1.0856. The pair is expected to find its first resistance at 1.1023, and a rise through could take it to the next resistance level of 1.1074.

Trading trends in the Euro today are expected to be determined by Germany’s GfK consumer confidence data, scheduled in a few hours. Meanwhile, initial jobless claims data in the US, scheduled later today would be closely monitored by the market participants.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.