For the 24 hours to 23:00 GMT, the GBP rose 0.26% against the USD and closed at 1.4883, following better than expected BBA mortgage approvals in the UK.

Data revealed that mortgage approvals in the UK rose to a 5-month high level of 37.31 K in February, compared to a revised reading of 36.52 K in the previous month. Market expectations were for BBA mortgage approvals to climb to 36.65 K, thus easing concerns over the health of Britain’s housing sector.

Separately, the BoE policy maker and rate setter, Minouche Shafik stated that interest rates in the UK were more likely to rise rather than going down, despite the nation’s falling inflation.

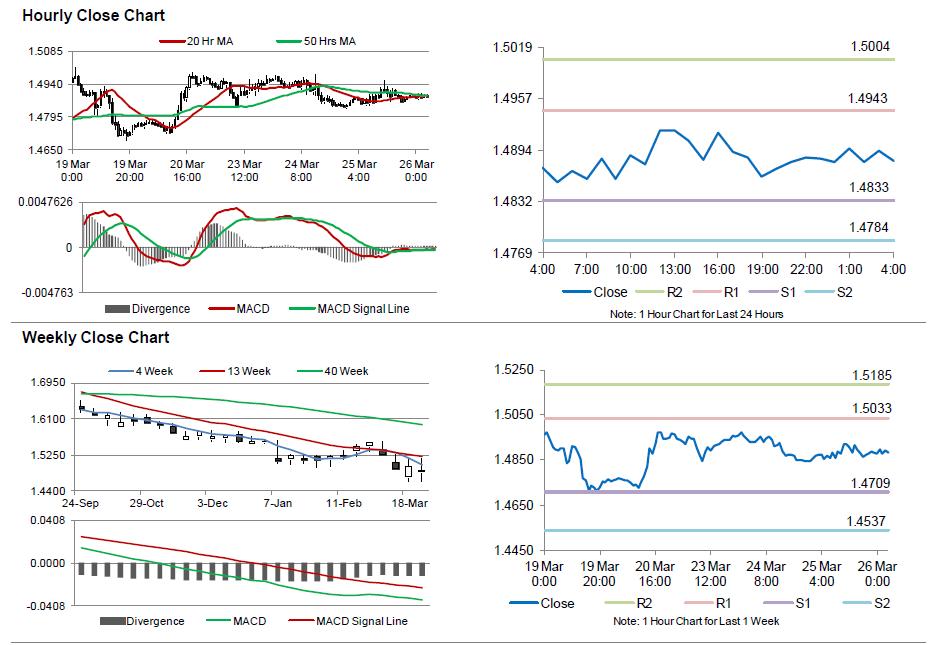

In the Asian session, at GMT0400, the pair is trading at 1.4881, with the GBP trading a tad lower from yesterday’s close.

The pair is expected to find support at 1.4833, and a fall through could take it to the next support level of 1.4784. The pair is expected to find its first resistance at 1.4943, and a rise through could take it to the next resistance level of 1.5004.

Looking ahead, investors await the release of UK’s retail sales data, scheduled in a few hours to get better insights in the nation’s economy.

The currency pair is trading slightly above its 20 Hr and 50 Hr moving averages.