For the 24 hours to 23:00 GMT, the EUR rose 0.10% against the USD and closed at 1.1789.

Yesterday, the European Court of Justice (ECJ) ruled that the ECB’s bond buying programme was legitimate, once certain conditions were met. The ruling cleared the obstacle for the launch of Euro area’s quantitative easing programme.

Elsewhere, in France, current account surplus stood at €0.20 billion in November, compared to a revised current account deficit of €0.40 billion in the prior month, while the nation’s EU normalised CPI registered an unexpected rise of 0.1% on a MoM basis in December, compared to a drop of 0.2% in the prior month. Meanwhile, Italy’s EU normalised CPI remained flat on a monthly basis in December.

The greenback traded in red after the US advance retail sales retreated 0.9% in December, compared to a revised advance of 0.4% recorded in the prior month. Market anticipations were for advance retail sales to drop 0.1%. Also, the nation’s business inventories advanced 0.2% in November, lower than market expectations for an advance of 0.3%.

Separately, the Fed’s latest Beige Book report indicated that most of the districts in the US reported “modest” to “moderate” growth from mid-November to late December, but consumer spending grew at a “slight to moderate” pace. Further, the Fed remained optimistic about the nation’s economic growth in 2015.

The Philadelphia Fed President, Charles Plosser, citing improvement in the US economic condition, urged the central bank to hike interest rates sooner rather than later in order to get ahead of future inflation. Furthermore, he projected US economic growth to slow to a trend of 2.4% in the future following an upbeat rise in the nation’s 2014 GDP.

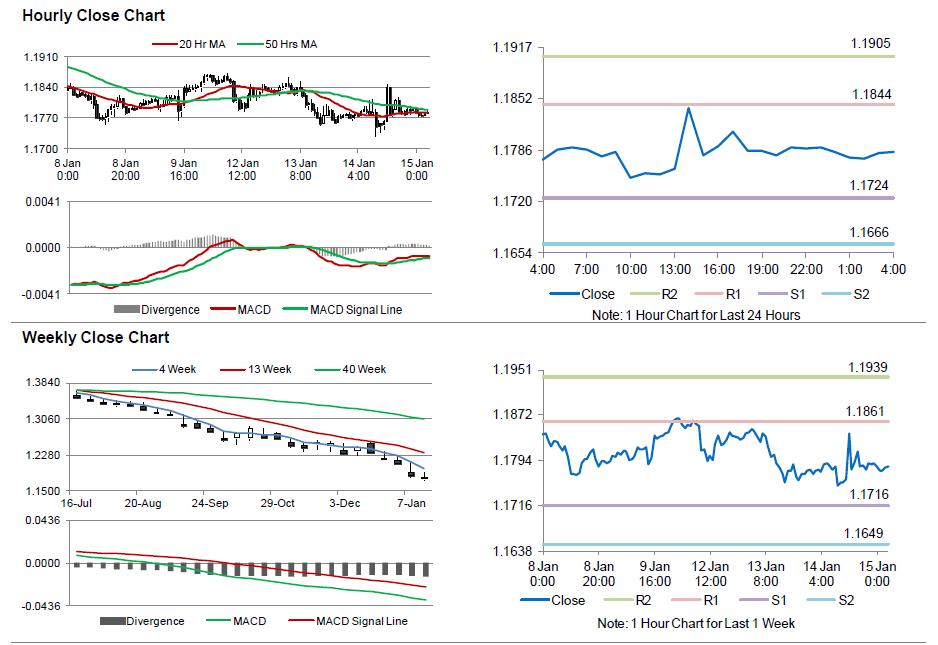

In the Asian session, at GMT0400, the pair is trading at 1.1783, with the EUR trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.1724, and a fall through could take it to the next support level of 1.1666. The pair is expected to find its first resistance at 1.1844, and a rise through could take it to the next resistance level of 1.1905.

Trading trends in the Euro today are expected to be determined Germany’s NSA GDP scheduled in few hours. Meanwhile, investors would also monitor weekly initial jobless claims data in the US, scheduled later today.

The currency pair is trading just above its 20 Hr moving average and showing convergence with its 50 Hr moving average.