For the 24 hours to 23:00 GMT, the GBP rose 0.48% against the USD and closed at 1.5236, reversing its previous session losses.

Yesterday, the BoE Governor, Mark Carney, in his testimony before the UK Treasury Select Committee, stated that sharp decline in oil prices was positive for the economic growth in the UK, but negative for the Scotland economy. Additionally, he mentioned that the ECB would take measures to meet its 2% inflation target.

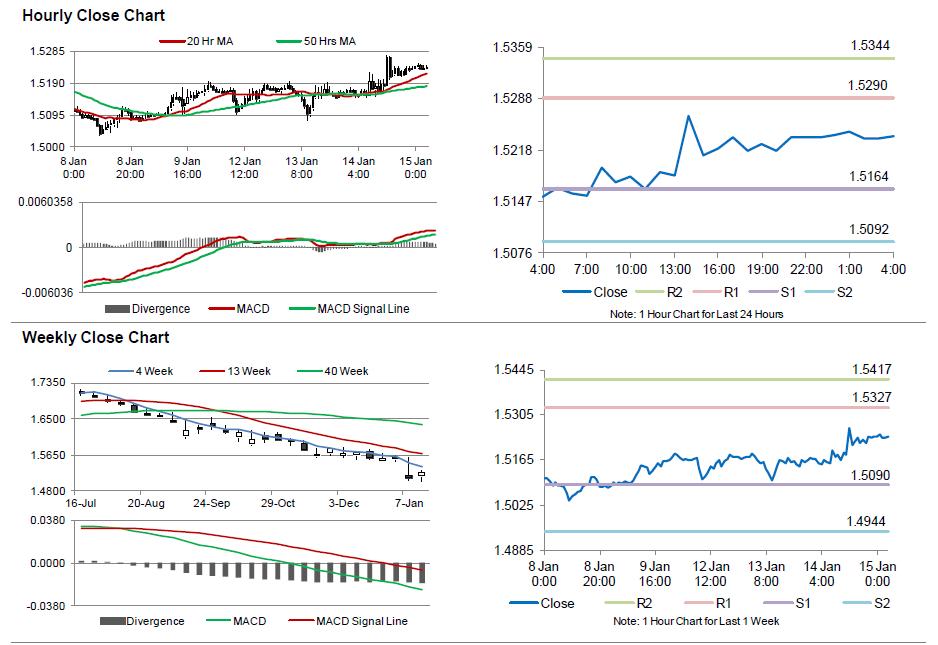

In the Asian session, at GMT0400, the pair is trading at 1.5237, with the GBP trading flat from yesterday’s close.

Early morning data showed that Britain’s RICS house price balance advanced more than expected, by 11%, in December after registering a rise of 13% in November.

The pair is expected to find support at 1.5164, and a fall through could take it to the next support level of 1.5092. The pair is expected to find its first resistance at 1.5290, and a rise through could take it to the next resistance level of 1.5344.

Trading trends in the Pound today would be determined by global macroeconomic news.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.