For the 24 hours to 23:00 GMT, the EUR declined 0.30% against the USD and closed at 1.3812, after data from Euro-zone’s largest economy, Germany showed that annual consumer inflation rate rose to 1.3% in April, slower than market expectation for a rise to 1.4%. Negative sentiment for the Euro was also fuelled after economic sentiment indicator in the Euro-zone economy unexpectedly dropped to a reading of 102.0 this month even as consumer confidence in the region improved to its highest level since November 2007 in April.

Separately, Italy’s Economy Minister, Pier Carlo Padoan highlighted the need for both fiscal and monetary policies to support growth in the Euro-zone economy while adding that implementing QE in the region would not be easy “because of the specificities of Euro-zone that is still not fully integrated.”

In other economic news, private sector loans in the Euro-zone fell 2.2% (YoY) in March while M3 money supply in the region rose 1.1% (YoY) in last month. Additionally, the GfK consumer confidence index in Germany remained steady at previous month’s level of 8.5 in May, matching economists’ estimates.

In a noteworthy development, rating agency Moody’s raised its outlook for the Greek banking system to “Stable” from “Negative,” amid expectation for a gradual improvement in the nation’s banking operating environment over the next 12 to 18 months.

Meanwhile, in the US, the Conference Board (CB) indicated that its index of consumer confidence fell more than expected to a reading of 82.3 in April from a revised reading of 83.9 in March.

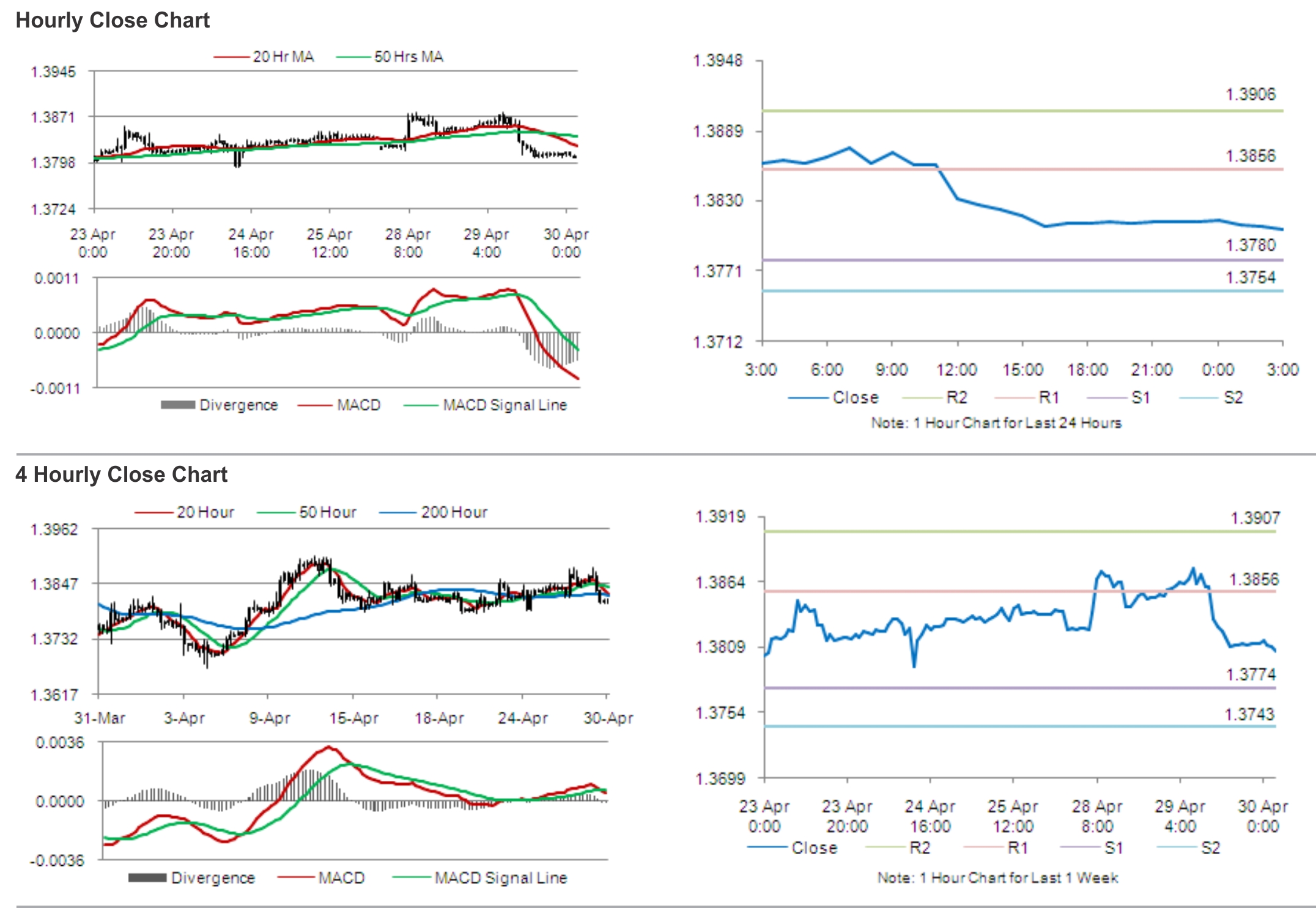

In the Asian session, at GMT0300, the pair is trading at 1.3806, with the EUR trading slightly lower from yesterday’s close.

The pair is expected to find support at 1.3780, and a fall through could take it to the next support level of 1.3754. The pair is expected to find its first resistance at 1.3856, and a rise through could take it to the next resistance level of 1.3906.

Later today, traders would eye the Euro-zone’s consumer inflation data, along with the US GDP and the Fed’s decision on its monetary policy, for further cues in the currency pair.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.