For the 24 hours to 23:00 GMT, the GBP rose 0.08% against the USD and closed at 1.6825, reversing its initial losses, triggered by a lacklustre UK GDP data for the first-quarter. Data showed that the Britain economy registered an annual growth of 3.1% in the first quarter of 2014, less than market expectations for a growth of 3.2%.

However, the British Pound gained ground after the Bank of England (BoE) Governor, Mark Carney expressed an optimistic outlook of the growth of the UK economy by stating that “there is every sign that the recovery is starting to broaden” but at the very same time he also highlighted the need for substantial increases in wages to ensure the UK economic recovery is sustained. Additionally, BoE’s Ian McCafferty stated that the “chances of a fully sustained recovery” were at the “highest” for a long time. He further opined that the UK central bank should not wait until the economy starts operating at full capacity for raising interest rates, if it plans to raise rates at a gradual pace.

In other economic news, the Gfk Group reported that its index on UK consumer confidence hit its highest level since June 2007 in April.

In the Asian session, at GMT0300, the pair is trading at 1.6826, with the GBP trading tad higher from yesterday’s close.

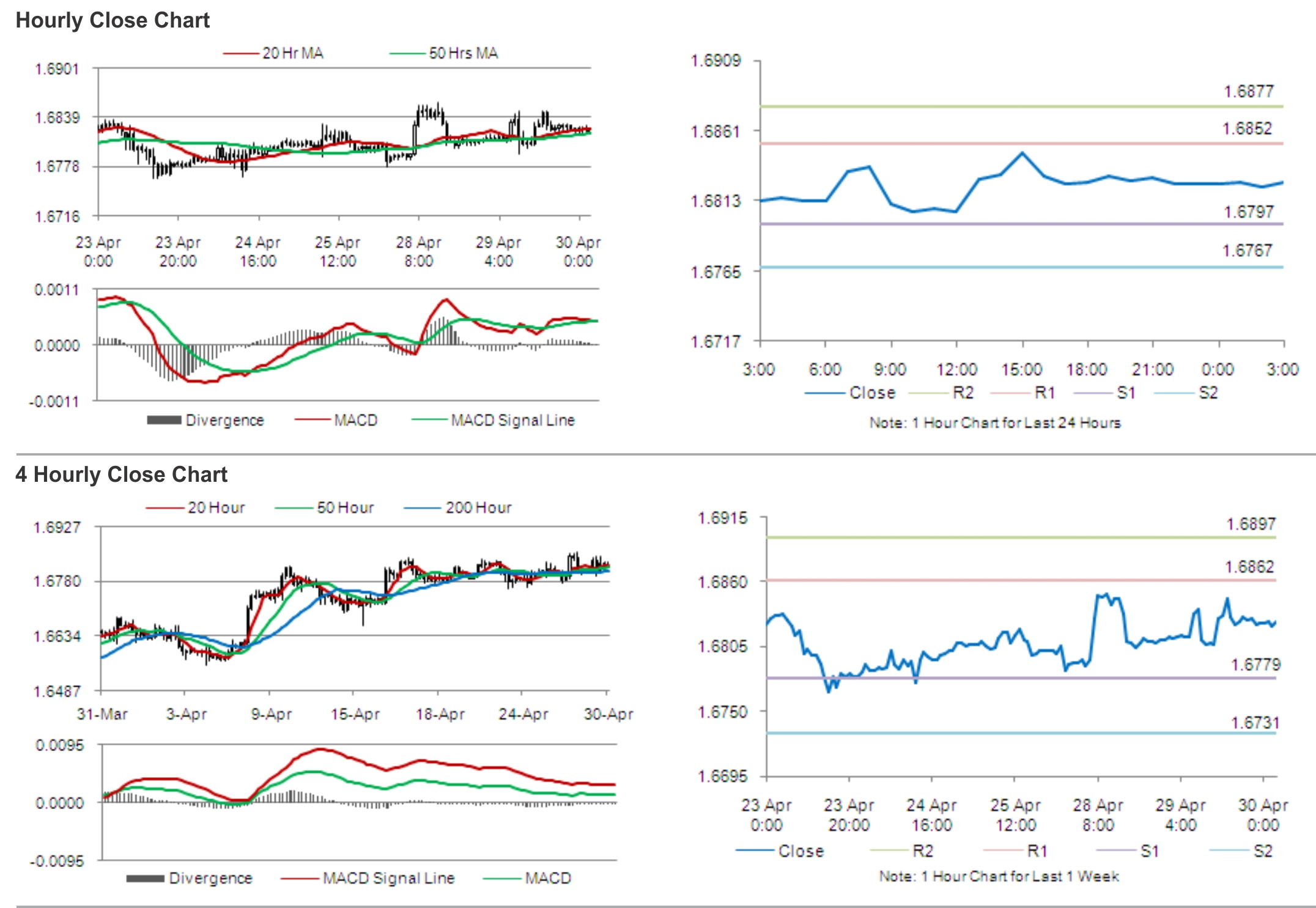

The pair is expected to find support at 1.6797, and a fall through could take it to the next support level of 1.6767. The pair is expected to find its first resistance at 1.6852, and a rise through could take it to the next resistance level of 1.6877.

Market participants are expected to keep a tab on a planned speech form the BoE’s MPC member, Spencer Dale, expected to commence later today.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.