For the 24 hours to 23:00 GMT, the EUR rose 0.14% against the USD and closed at 1.2670, extending its previous session gains.

In economic news, the seasonally adjusted German industrial output fell 4.0% on a monthly basis in August, posting its worst fall since 2009, higher than market expected fall of 1.5%. In the previous month, industrial production had climbed by a revised 1.6%.

Separately, the ECB’s Governing Council Member, Klaas Knot stated that the central bank will continue with its current accommodative monetary policy as the Euro-zone was still suffering from low inflation and a “fragile” economic recovery.

Elsewhere, French budget deficit widened to €94.1 billion in August.

In the US, the economic optimism index remained steady at 45.2 in October. Markets expectations were for it to drop to a level of 45.1. Additionally, the nation’s JOLTS job openings recorded a rise to 4835.0 K, compared to market expectations of a rise to a level of 4700.0 and compared to a revised level of 4605.0 K registered in the previous month. Meanwhile, consumer credit advanced by $13.53 billion in August compared to a revised rise of $21.61 billion in the previous month. Market expectations were for consumer credit to rise by $20.0 billion.

Yesterday, the New York Fed President, William Dudley expressed his upbeat view over the US economic growth and added that the Fed could reasonably be expected to raise its interest rates in mid-2015.

The Minneapolis Fed President Narayana Kocherlakota, indicated that the US inflation was not likely to rise to the Fed’s 2% target until 2018 and hence he urged the policymakers to keep interest rates near zero through at least the end of next year.

The IMF cut its global economy growth forecast to 3.3% in 2014, down from its previous estimate of 3.4% forecasted in July. It expects world economy to grow 3.8% in 2015 against its previous expectation of 4% growth. It further warned the Euro-zone of its prolonged period of low inflation and sluggish growth, as it is hampering the region’s economic recovery.

In the Asian session, at GMT0300, the pair is trading at 1.263, with the EUR trading 0.32% lower from yesterday’s close.

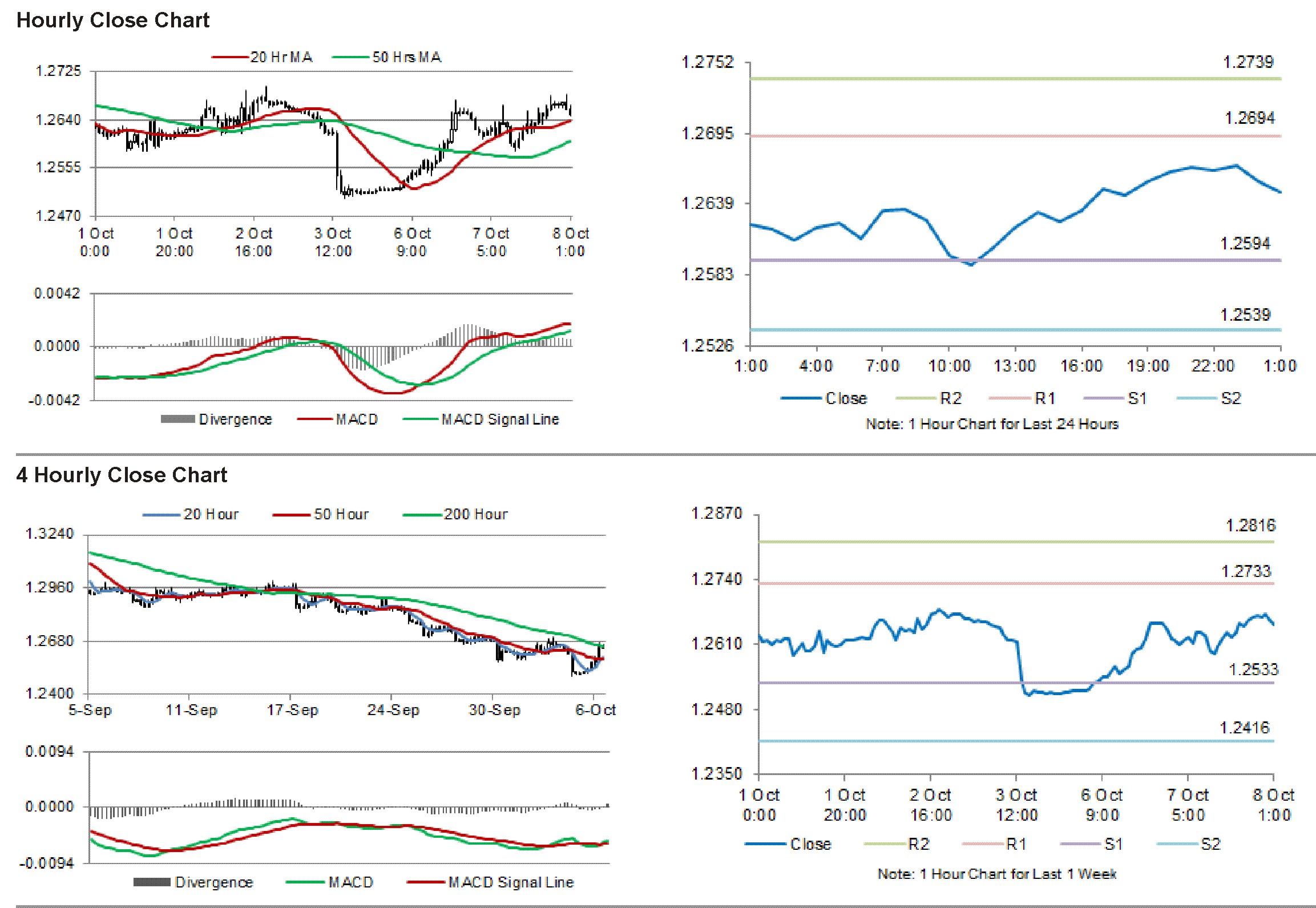

The pair is expected to find support at 1.2581, and a fall through could take it to the next support level of 1.2533. The pair is expected to find its first resistance at 1.2681, and a rise through could take it to the next resistance level of 1.2733.

Meanwhile, investors would keep a close eye on the Fed minutes, scheduled later in the day.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.