For the 24 hours to 23:00 GMT, the GBP rose 0.13% against the USD and closed at 1.6098, after a leading think tanker NIESR in its monthly GDP estimate reported that the UK economy grew 0.7% % for the three months to September, compared to a revised rise of 0.8% for the three months ended in August.

Separately, the IMF reported that British economy would be the fastest growing economy among the G-7 nations as it expects the UK economy to grow 3.2% in 2014 and 2.7% in 2015.

In other economic data, the UK manufacturing production rose 0.1% on a monthly basis in August, at par with market expectations, while industrial production remained steady in the same month. Meanwhile, the BoE in its quarterly credit conditions survey revealed that demand for secured lending by households essentially mortgages fell significantly in the third quarter of 2014, due to reduced risk appetite and concerns about the outlook for house prices.

In the Asian session, at GMT0300, the pair is trading at 1.6061, with the GBP trading 0.23% lower from yesterday’s close.

Overnight data indicated that the BRC shop price index in the UK eased 1.8% on an annual basis in September, after registering a drop of 1.6% in the prior month.

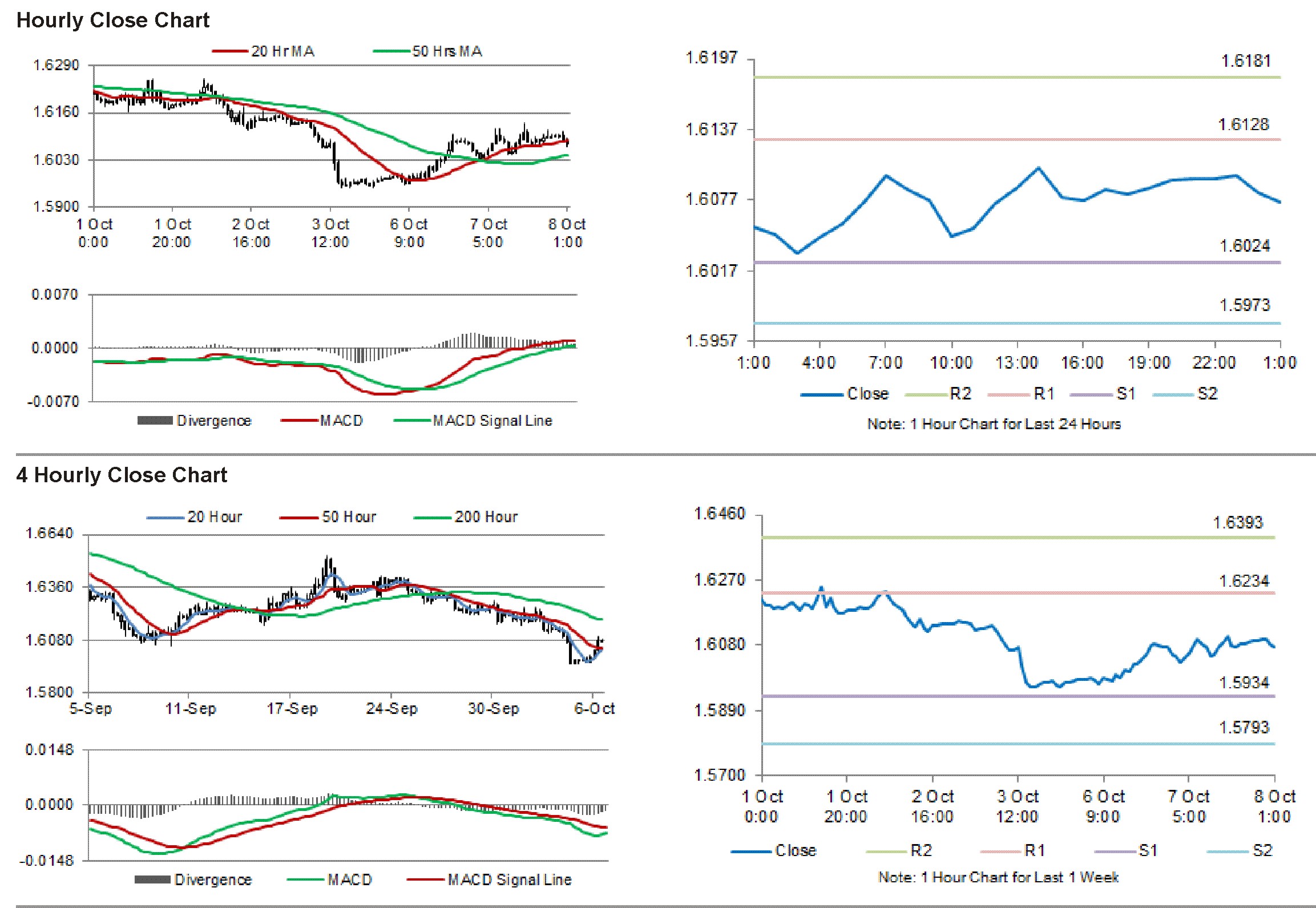

The pair is expected to find support at 1.6015, and a fall through could take it to the next support level of 1.5968. The pair is expected to find its first resistance at 1.6119, and a rise through could take it to the next resistance level of 1.6176.

Trading trends in the Pound today would be determined by global macroeconomic news.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.