For the 24 hours to 23:00 GMT, the EUR rose 0.47% against the USD and closed at 1.2350.

In economic news, the US NFIB small business optimism index advanced more-than-expected to a level of 106.9 in January, as small firms expressed greater confidence that the recent Tax Cuts and Jobs Act would boost the nation’s economic activity. In the previous month, the index had registered a level of 104.9, while markets were expecting for a rise to a level of 105.3.

Separately, the Federal Reserve (Fed) Chairman, Jerome Powell, stated that the global economic recovery is on a robust growth path for the first time in a decade, but cautioned that the central bank needs to remain vigilant to any emerging threats to financial stability. Nevertheless, he suggested that the central bank would continue gradual interest-rate hikes.

In the Asian session, at GMT0400, the pair is trading at 1.2390, with the EUR trading 0.32% higher against the USD from yesterday’s close.

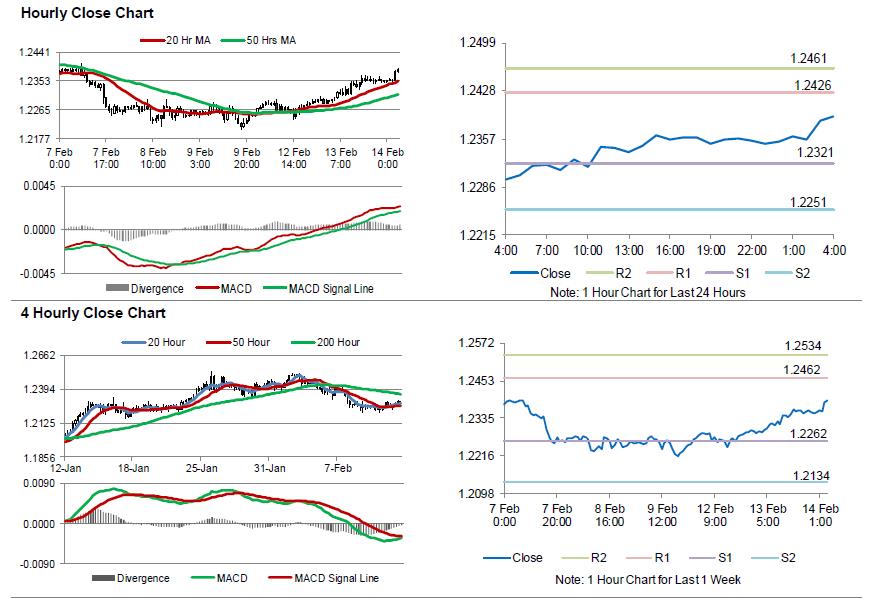

The pair is expected to find support at 1.2321, and a fall through could take it to the next support level of 1.2251. The pair is expected to find its first resistance at 1.2426, and a rise through could take it to the next resistance level of 1.2461.

Moving ahead, investors would closely monitor the flash 4Q GDP figures scheduled to release across the Euro-zone in a few hours. Additionally, Germany’s final inflation figures for January as well as Euro-zone’s industrial production data for December, will be eyed by traders. Later in the day, the US inflation and retail sales figures for January, would pique significant amount of market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.