For the 24 hours to 23:00 GMT, the GBP rose 0.32% against the USD and closed at 1.3885, boosted by better-than-expected UK inflation figures.

Data showed that Britain’s consumer price index (CPI) rose more-than-expected by 3.0% on an annual basis in January, suggesting that the Bank of England (BoE) needs to explore the possibility of raising interest rates soon as inflation continues to accelerate. In the previous month, the CPI had registered a similar rise, while markets were anticipating for a gain of 2.9%.

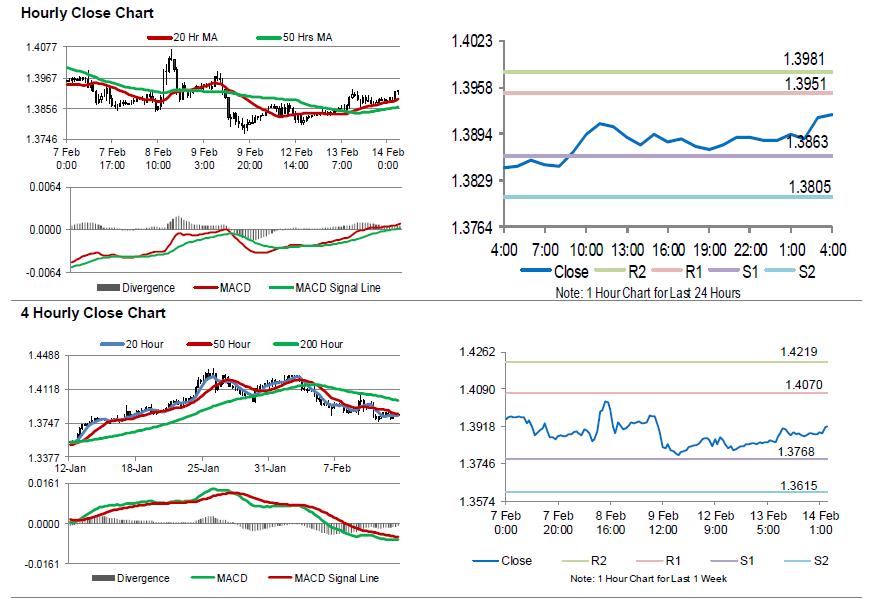

In the Asian session, at GMT0400, the pair is trading at 1.3920, with the GBP trading 0.25% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.3863, and a fall through could take it to the next support level of 1.3805. The pair is expected to find its first resistance at 1.3951, and a rise through could take it to the next resistance level of 1.3981.

Amid a lack of macroeconomic releases in the UK today, investor sentiment would be determined by global macroeconomic factors.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.