For the 24 hours to 23:00 GMT, the EUR rose 0.45% against the USD and closed at 1.1862.

The US Dollar traded in the negative territory against its major counterparts, after minutes of the September FOMC meeting revealed lingering concerns about persistently low inflation.

Minutes indicated that policymakers are tilting towards the prospects for another interest rate hike before this year-end. However, officials issued concerns that low inflation could not only be a temporary phenomenon and as such few believed that “some patience” was warranted in hiking interest rates in order to assess trends in inflation.

On the data front, the US JOLTS job openings dropped to a level of 6082.0K in August, higher than market expectations for a fall to a level of 6125.0K. JOLTS job openings had registered a revised reading of 6140.0K in the prior month. Moreover, the nation’s MBA mortgage applications eased 2.1% in the week ended 06 October. In the previous week, mortgage applications had fallen 0.4%.

In the Asian session, at GMT0300, the pair is trading at 1.1873, with the EUR trading 0.09% higher against the USD from yesterday’s close.

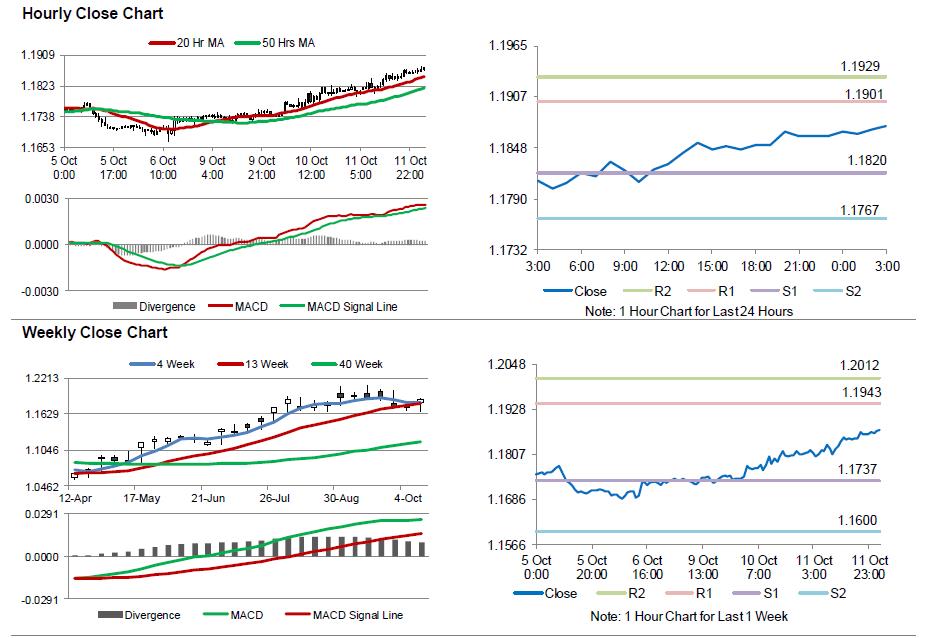

The pair is expected to find support at 1.1820, and a fall through could take it to the next support level of 1.1767. The pair is expected to find its first resistance at 1.1901, and a rise through could take it to the next resistance level of 1.1929.

Moving ahead, investors will keep a close watch on a speech by the European Central Bank (ECB) President, Mario Draghi, due later today. Traders would also eye the Euro-zone’s industrial production data for August, slated to release in a few hours. Moreover, the US initial jobless claims and the monthly budget statement for September, both slated to release later in the day, will be on investors’ radar.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.