For the 24 hours to 23:00 GMT, the GBP rose 0.2% against the USD and closed at 1.3229.

Meanwhile, UK’s Chancellor of the Exchequer, Philip Hammond, stated that Brexit has clouded Britain’s economic outlook and added that the Government is preparing for the potential of a “hard Brexit” in 2019.

In the Asian session, at GMT0300, the pair is trading at 1.3252, with the GBP trading 0.17% higher against the USD from yesterday’s close.

Overnight data indicated that Britain’s RICS house price balance remained unchanged at a level of 6.0 in September, compared to market expectations of a drop to a level of 4.0.

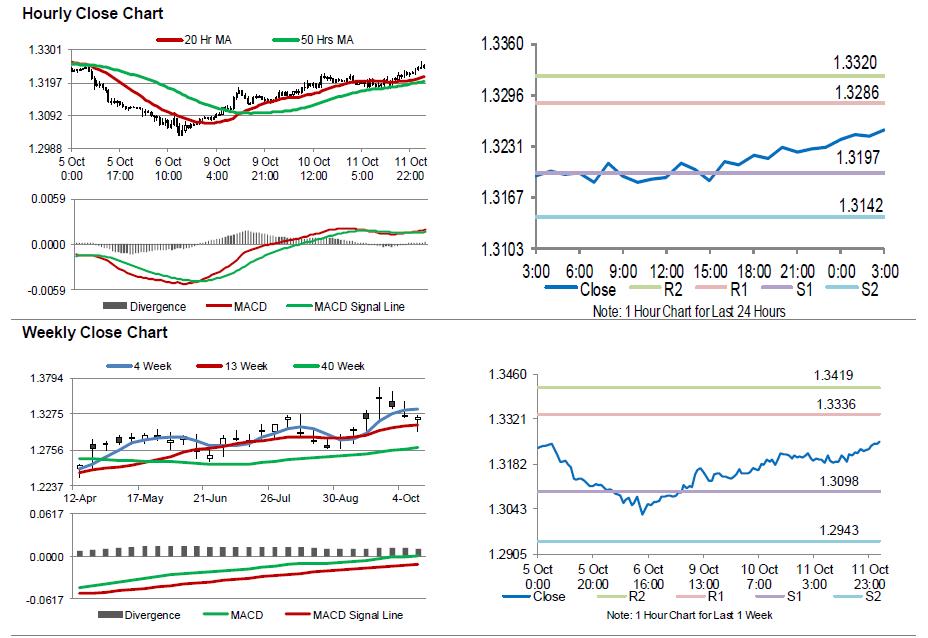

The pair is expected to find support at 1.3197, and a fall through could take it to the next support level of 1.3142. The pair is expected to find its first resistance at 1.3286, and a rise through could take it to the next resistance level of 1.3320.

Going ahead, traders will look forward to the Bank of England’s credit conditions survey report, due to release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.