For the 24 hours to 23:00 GMT, the EUR rose 0.40% against the USD and closed at 1.1355.

In economic news, the Euro-zone’s ZEW economic sentiment index advanced to a level of 21.5 in April, following a reading of 10.3 in the previous month. Additionally, Germany’s economic sentiment index climbed more-than-expected to a level of 11.2 in April, compared to market expectations of a rise to 8.0. In the previous month, the economic sentiment index had registered a reading of 4.3.

On the other hand, the Euro-zone’s seasonally adjusted construction output slid 1.1% MoM in February, after having risen by a revised 2.4% in the previous month.

The greenback lost ground, after weak US housing data reinforced views of a dovish Fed. Data showed that US housing starts registered a drop of 8.8% MoM in March, to an annual rate of 1089.0K. Markets were anticipating housing starts to ease to a level of 1166.0K, compared to a revised level of 1194.0K in the previous month. Additionally, the nation’s building permits unexpectedly fell by 7.7% MoM in March, to an annual rate of 1086.0K in the US, compared to a revised reading of 1177.0K in the previous month. Market anticipation was for building permits to rise to a level of 1200.0K.

In the Asian session, at GMT0300, the pair is trading at 1.1368, with the EUR trading 0.11% higher from yesterday’s close.

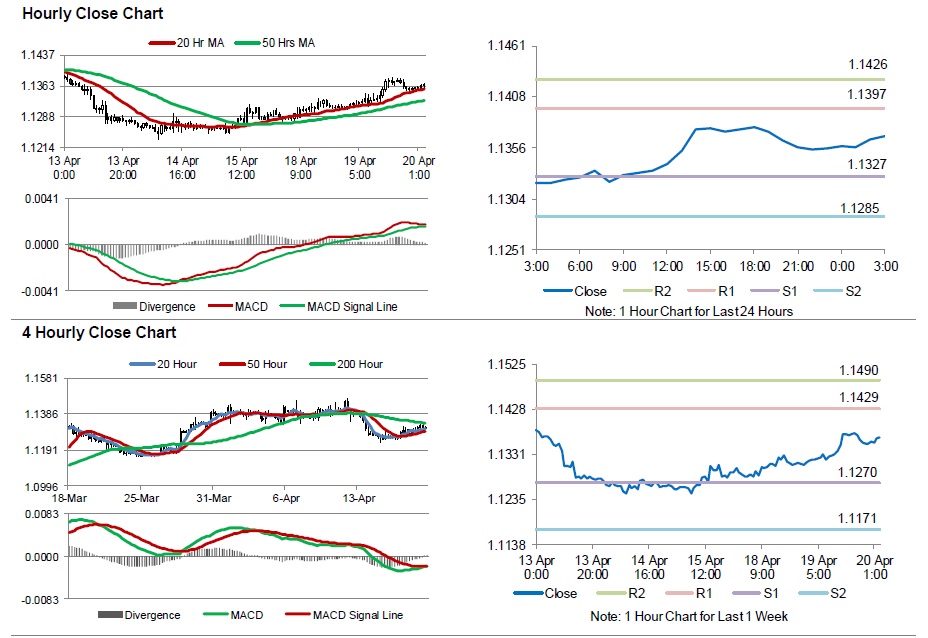

The pair is expected to find support at 1.1327, and a fall through could take it to the next support level of 1.1285. The pair is expected to find its first resistance at 1.1397, and a rise through could take it to the next resistance level of 1.1426.

Going ahead, investors will look forward to Germany’s producer price index data for March, scheduled to release in a few hours. Moreover, the US existing home sales and MBA mortgage applications data, due later today, will also attract market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.