For the 24 hours to 23:00 GMT, the GBP rose 0.76% against the USD and closed at 1.4384.

Yesterday, the Bank of England (BoE) Governor, Mark Carney, warned that UK’s exit from the European Union posed the biggest threat to the nation’s financial stability. Further, he pointed out certain risks related to the referendum such as pressure on Britain’s “remarkably high” current account deficit, its property markets and liquidity in financial markets and added that uncertainty regarding the vote was already hitting the nation’s growth outlook.

In the Asian session, at GMT0300, the pair is trading at 1.4382, with the GBP trading marginally lower from yesterday’s close.

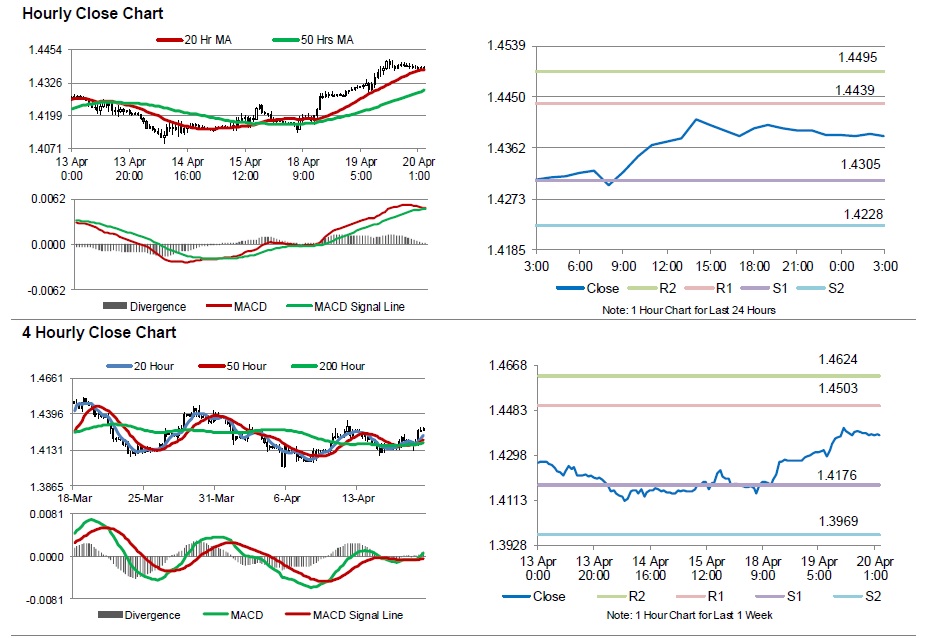

The pair is expected to find support at 1.4305, and a fall through could take it to the next support level of 1.4228. The pair is expected to find its first resistance at 1.4439, and a rise through could take it to the next resistance level of 1.4495.

Moving ahead, investors will look forward to the release of UK’s ILO unemployment rate data for February, scheduled to release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.