For the 24 hours to 23:00 GMT, the EUR rose 0.52% against the USD and closed at 1.0985.

In economic news, the Euro-zone’s consumer confidence weakened to -7.1 in July, from -5.6 in June, indicating that the threat of Greece exiting the Euro-zone weighed on the consumer confidence.

In the US, the number of people claiming jobless benefits for the first time fell to a four-decade low level of 255 K in the week ended 18 July, from prior week’s level of 281 K, showing that the US labour market is strengthening.

Other economic data showed that the US Kansas City Fed manufacturing activity index rose to -7.00, compared to a reading of -9.00 in the previous month. Market expectation were for it to advance to -5.0.

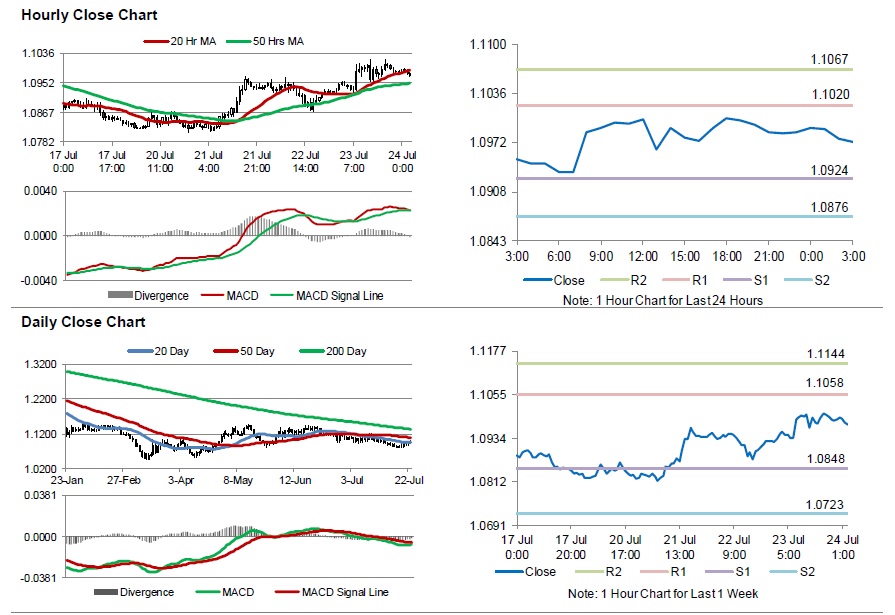

In the Asian session, at GMT0300, the pair is trading at 1.0972, with the EUR trading 0.11% lower from yesterday’s close.

The pair is expected to find support at 1.0924, and a fall through could take it to the next support level of 1.0876. The pair is expected to find its first resistance at 1.1020, and a rise through could take it to the next resistance level of 1.1067.

Trading trends in the Euro today are expected to be determined by the services and manufacturing PMI figures from the Euro-zone and its peripheries, scheduled in a few hours.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.