For the 24 hours to 23:00 GMT, the GBP fell 0.65% against the USD and closed at 1.5515, after the release of dismal retail sales data in the UK.

Yesterday, data released showed that retail sales in the UK slipped 0.2% on a monthly basis in June, reversing market expectations for a similar 0.3% rise, which was recorded in May. Additionally, the annual retail sales growth also slowed and registered its slowest rate since September 2014 in June, thus denting investor optimism over the nation’s economic outlook.

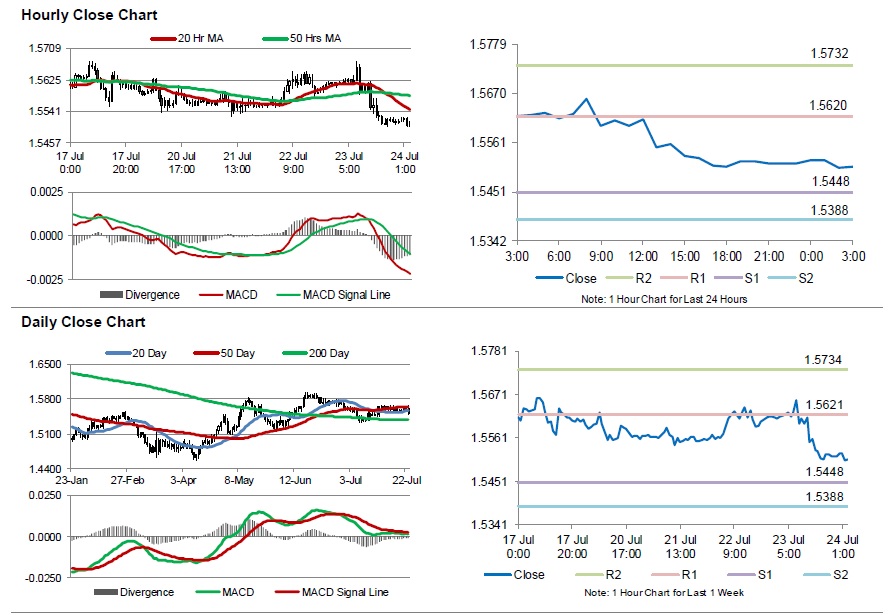

In the Asian session, at GMT0300, the pair is trading at 1.5508, with the GBP trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.5448, and a fall through could take it to the next support level of 1.5388. The pair is expected to find its first resistance at 1.5620, and a rise through could take it to the next resistance level of 1.5732.

Moving ahead, UK’s 2Q GDP data, scheduled next week would generate lot of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.