For the 24 hours to 23:00 GMT, the EUR declined 0.57% against the USD and closed at 1.0891 as the greenback benefited from a Fed official’s hawkish comments.

Atlanta Fed Chief, Dennis Lockhart, expressed his optimism over the US economy and lent his support for an interest rate hike by the central bank as early as next month.

In the US, factory orders rebounded 1.8% in June, led by a robust demand for the commercial aircraft. It followed a revised drop of 1.1% recorded in the preceding month.

Other economic data showed that the New York City current business condition index in the US advanced to 68.80, from a level of 63.10 in the prior month. Meanwhile, the nation’s economic optimism index eased to 46.90 in August, lower than market expectations of a fall to a level of 47.60. In the previous month, the index had registered a level of 48.10.

In the Asian session, at GMT0300, the pair is trading at 1.0861, with the EUR trading 0.27% lower from yesterday’s close.

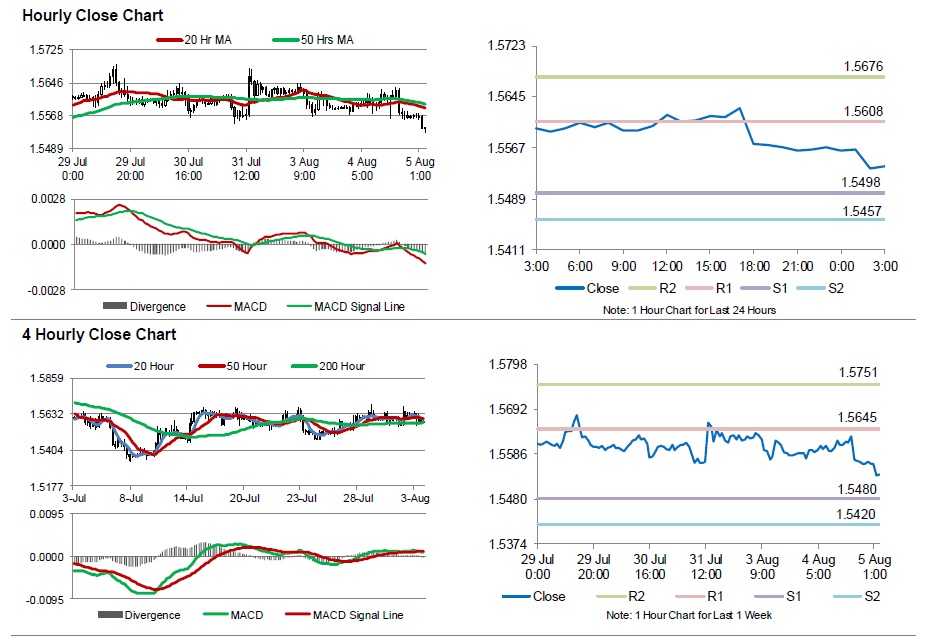

The pair is expected to find support at 1.0809, and a fall through could take it to the next support level of 1.0758. The pair is expected to find its first resistance at 1.0951, and a rise through could take it to the next resistance level of 1.1042.

Trading trends in the Euro today are expected to be determined by the services PMI data from the Euro-zone and its peripheries, scheduled in a few hours. Meanwhile, the US ADP employment numbers and non-manufacturing composite PMI, scheduled later today would grab lot of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.