For the 24 hours to 23:00 GMT, the GBP fell 0.12% against the USD and closed at 1.5568 after UK’s construction PMI unexpectedly fell to a level of 57.10 in July, following a four-month high of 58.10 in the prior month. Markets had expected the index to advance to 58.50 in July.

Other economic data showed that Nationwide house prices rose by 0.4% MoM in July, in line with market expectations and compared to a 0.2% drop in the previous month, suggesting that the UK home values were stabilising.

In the Asian session, at GMT0300, the pair is trading at 1.5539, with the GBP trading 0.19% lower from yesterday’s close.

Think-tank, NIESR, is of the belief that UK economy would grow by 0.4% in the three months to September, lower than its 0.8% forecast it made in May. Meanwhile, Britain’s BRC shop price index dropped 1.40% YoY in July, after registering a 1.30% fall in the previous month.

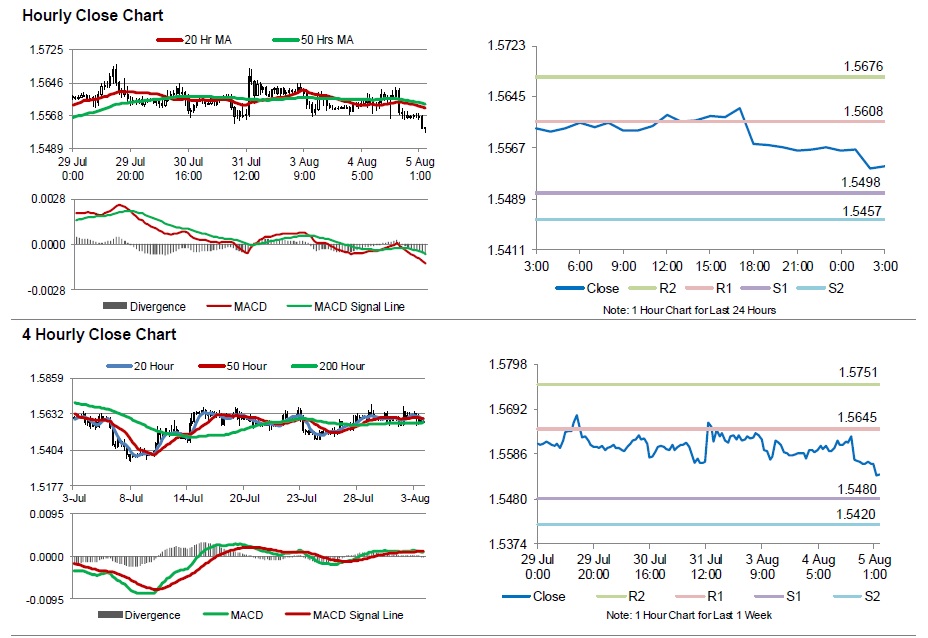

The pair is expected to find support at 1.5498, and a fall through could take it to the next support level of 1.5457. The pair is expected to find its first resistance at 1.5608, and a rise through could take it to the next resistance level of 1.5676.

Trading trends in the pair today are expected to be determined by services PMI data for July, scheduled to release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.