For the 24 hours to 23:00 GMT, the EUR declined 0.75% against the USD and closed at 1.1404, after the ECB, in its economic bulletin, issued a gloomy inflation outlook and warned over downside risks to the Euro-zone economy. Further, the central bank stated that domestic demand continues to support economic recovery in the Euro-zone and reiterated that it is ready to use all available instruments to stimulate growth in the 19-nation bloc.

In the US, the seasonally adjusted initial jobless claims rose more-than-expected to 274.0K in the week ended 30 April 2016, compared to market expectations of a rise to a level of 260.0K. In the previous week, initial jobless claims had registered a level of 257.0K.

Separately, the St. Louis Fed President, James Bullard, a voting member of the Federal Open Market Committee, stated that he is undecided on the path forward for US interest rates. He further stated that global headwinds that have partly prevented the US central bank from raising rates again might have dissipated and that Britain’s upcoming referendum on the European Union is not likely to affect the US economy.

In the Asian session, at GMT0300, the pair is trading at 1.1406, with the EUR trading marginally higher from yesterday’s close.

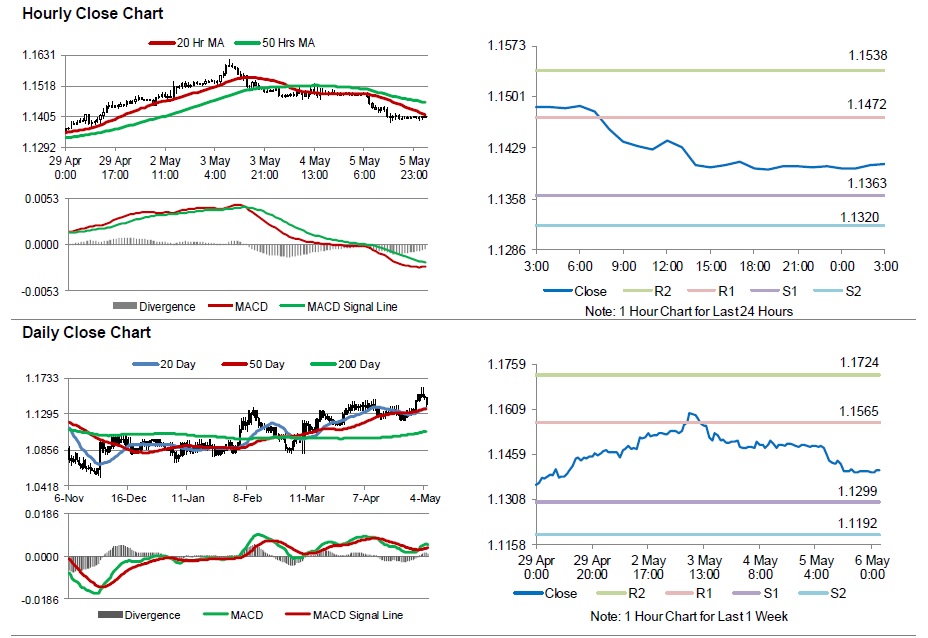

The pair is expected to find support at 1.1363, and a fall through could take it to the next support level of 1.1320. The pair is expected to find its first resistance at 1.1472, and a rise through could take it to the next resistance level of 1.1538.

Going ahead, investors will look forward to Germany’s construction PMI data for April, scheduled to release in a few hours. Additionally, the US non-farm payrolls and unemployment rate data, due later today, will also garner a significant amount of market attention.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.