For the 24 hours to 23:00 GMT, the GBP fell 0.09% against the USD and closed at 1.4491, after UK’s Markit service PMI declined more-than-expected to a level of 52.3 in April, its lowest reading in more than three years, as the British economy feels the jitters ahead of June’s European Union referendum and in further indication that the nation’s second quarter growth is likely to come in weak.

In the Asian session, at GMT0300, the pair is trading at 1.4483, with the GBP trading marginally lower from yesterday’s close.

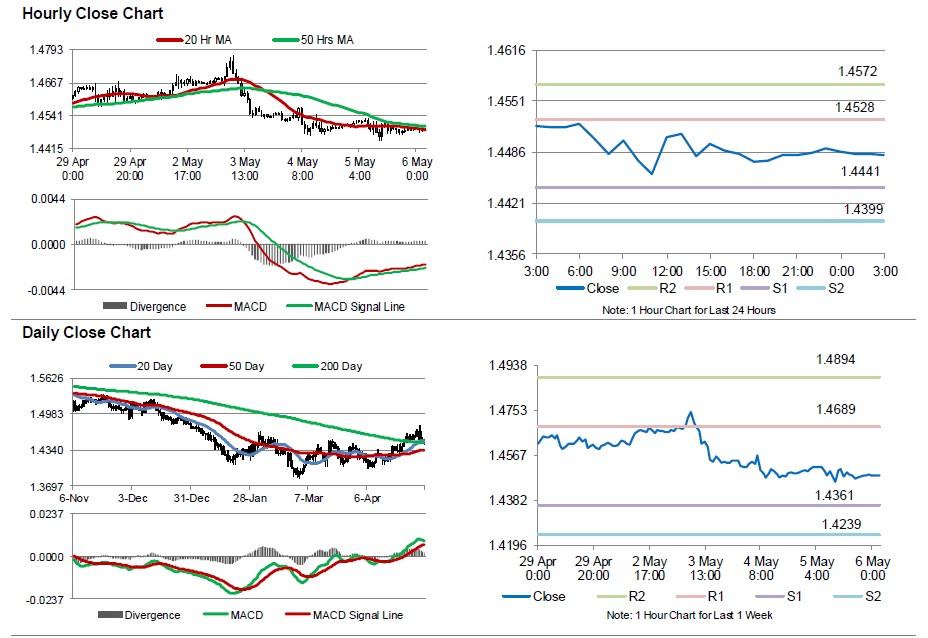

The pair is expected to find support at 1.4441, and a fall through could take it to the next support level of 1.4399. The pair is expected to find its first resistance at 1.4528, and a rise through could take it to the next resistance level of 1.4572.

Going ahead, investors will look forward to the BoE’s interest rate decision, along with UK’s total trade balance, industrial production and the NIESR GDP estimate data, all scheduled to release next week.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.