For the 24 hours to 23:00 GMT, the EUR rose 0.15% against the USD and closed at 1.0882.

In economic news, German factory orders fell for the third consecutive month by 1.7% MoM in September, after declining by 1.8% in the previous month, thus signalling a weakness in the Euro-zone’s largest economy. Investors had expected it to rise 1.0%. Also, Germany’s Markit construction PMI dropped to a level of 51.8 in October, from a reading of 52.4 in the previous month. In addition to this, retail sales in the Euro-zone unexpectedly fell 0.1% MoM in September, after staying flat in the previous month. Market participants had expected it to rise 0.2%.

Separately, the ECB President, Mario Draghi, stated that the central bank’s quantitative easing programme implemented so far has been effective and that it may be extended for much longer, after assessing the economic situation at its December meeting. He further added that the central bank has several other monetary tools at its disposal in order to achieve its annual inflation target of 2%. In other news, the European Union predicted that economic recovery in the Eurozone will continue at a modest pace next year, despite challenges.

The greenback lost ground after initial jobless claims rose more-than-expected to a level of 276K in the week ended 31 October, from a reading of 260K in the previous week. Investors had expected it to record a level of 264K.

Meanwhile, the President of the Atlanta Fed, Dennis Lockhart, hinted at an imminent rate hike by suggesting that the global economy has improved enough to withstand it.

In the Asian session, at GMT0400, the pair is trading at 1.0886, with the EUR trading marginally higher from yesterday’s close.

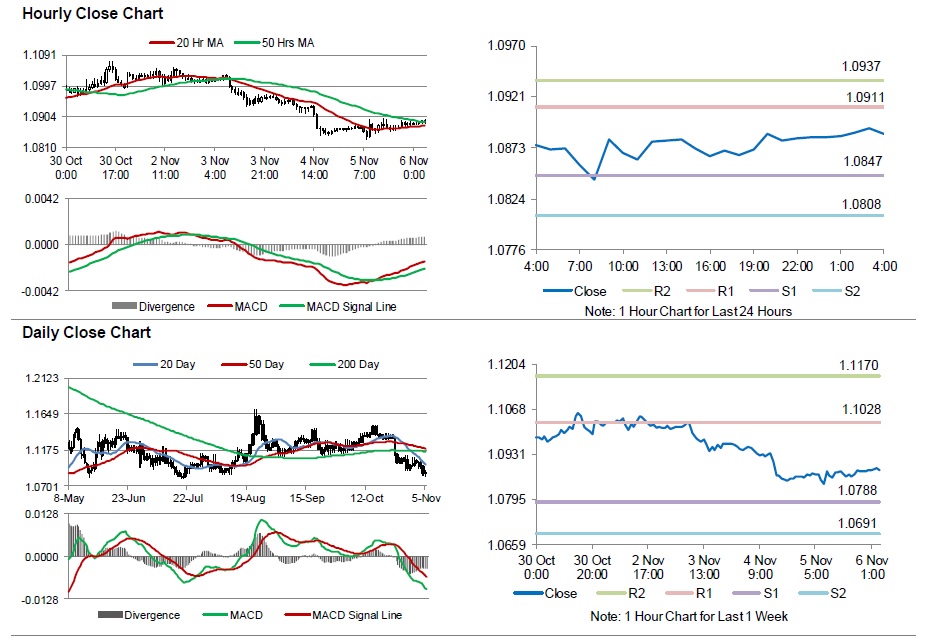

The pair is expected to find support at 1.0847, and a fall through could take it to the next support level of 1.0808. The pair is expected to find its first resistance at 1.0911, and a rise through could take it to the next resistance level of 1.0937.

Going ahead, market participants will look forward to Germany’s industrial production data for September, scheduled to be released in a few hours. Moreover, the US unemployment rate, nonfarm payrolls data, scheduled to be released later today, will grab a significant amount of investor attention.

The currency pair is trading above its 20 Hr moving average and is showing convergence with its 50 Hr moving average.