For the 24 hours to 23:00 GMT, the GBP fell 1.16% against the USD and closed at 1.5210.

Yesterday, The BoE Governor, Mark Carney, indicated that UK’s benchmark interest rates will stay low for a longer period.

The minutes from the BoE’s most recent monetary policy meeting showed that the policymakers decided to keep key interest rates on hold, at a record low of 0.5%, as the committee signalled that underlying price pressures were not robust enough to justify tightening of the policy. The BoE also maintained its asset purchase facility steady at £375 billion. Further, in its inflation report, the central bank lowered UK’s growth forecast for 2015 and 2016 to 2.7% and 2.5%, respectively, from its earlier projection of 2.8% and 2.6%.

Meanwhile, the central bank Governor stated that he still feels a gradual interest rate hike is required in order to attain its target inflation rate. He added that the global economic growth outlook has weakened since the BoE’s previous inflation report and that the country needs to maintain low interest rates for a further period as China continues to drag on the world economy.

In the Asian session, at GMT0400, the pair is trading at 1.5215, with the GBP trading marginally higher from yesterday’s close.

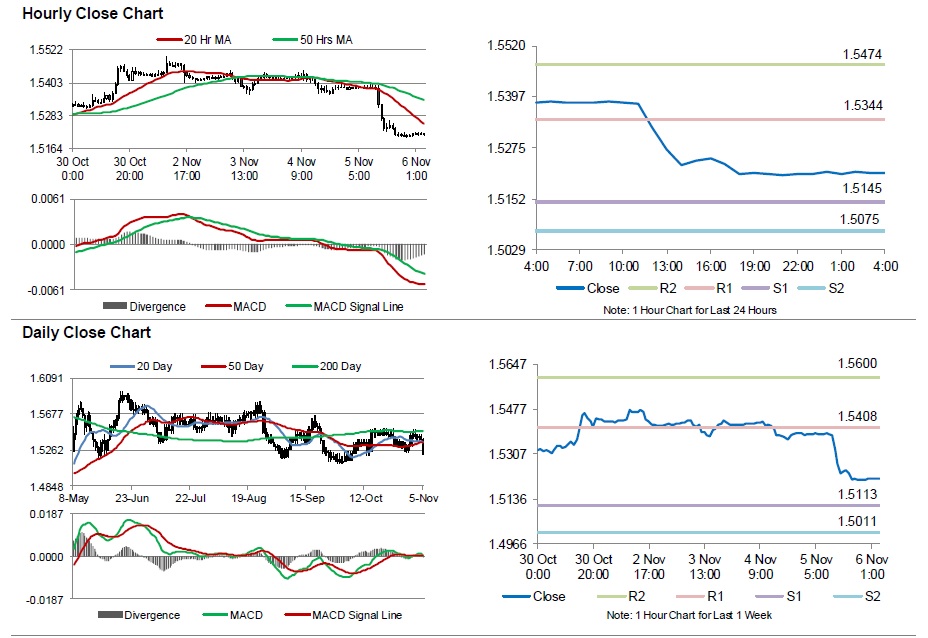

The pair is expected to find support at 1.5145, and a fall through could take it to the next support level of 1.5075. The pair is expected to find its first resistance at 1.5344, and a rise through could take it to the next resistance level of 1.5474.

Going ahead, investors will look forward to UK’s industrial production and manufacturing production data, both for the month of September, scheduled to be released in a few hours. In addition to this, the nation’s NIESR GDP estimate data, scheduled to be released later today, will also attract market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.