For the 24 hours to 23:00 GMT, the EUR declined 0.59% against the USD and closed at 1.0933.

In economic news, the German ZEW economic sentiment survey exceeded investor expectations and reached a four-month high level of 16.1 in December, fuelling optimism over the health of the Euro-zone’s largest economy. It had recorded a reading of 10.4 in the previous month. Additionally, the index of Euro-zone economic sentiment rose to a level of 33.9 in December, from 28.3 a month earlier.

The greenback gained ground, after the US CPI and core CPI on a monthly basis in November, were in-line with investor expectations at null and 0.2% respectively. On an annual basis, US consumer prices rose 0.5%, notching its largest gain since last December, following a 0.2% growth in October, thus further cementing expectations for a hike in interest rates. On the other hand, the nation’s NAHB housing market index surprisingly fell to a level of 61.0 in December, after posting a reading of 62.0 in the previous month and compared to investor expectations for a reading of 63.0.

In the Asian session, at GMT0400, the pair is trading at 1.0938, with the EUR trading marginally higher from yesterday’s close.

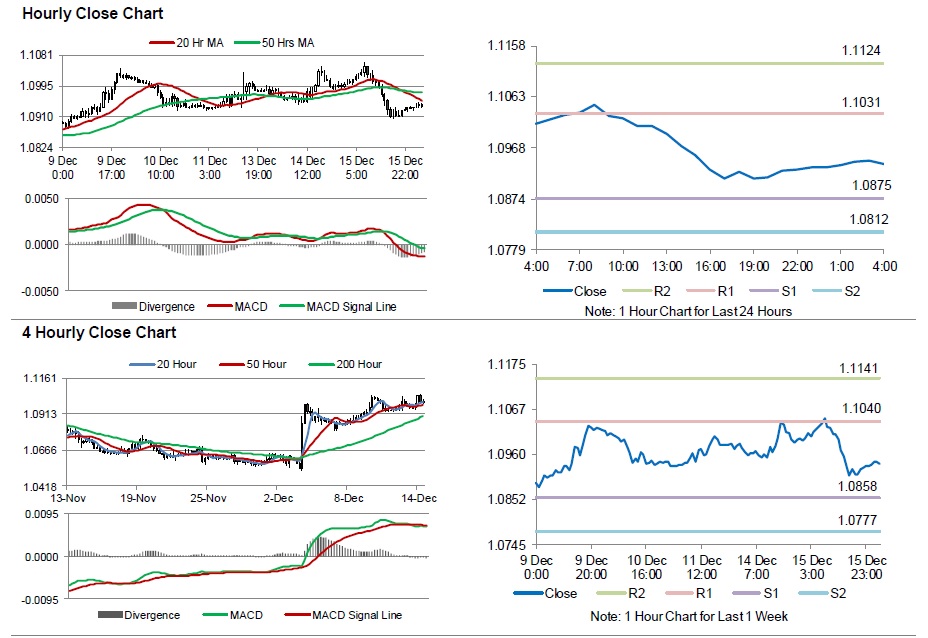

The pair is expected to find support at 1.0875, and a fall through could take it to the next support level of 1.0812. The pair is expected to find its first resistance at 1.1031, and a rise through could take it to the next resistance level of 1.1124.

Moving ahead, market participants will look forward to the Markit manufacturing and services PMI data across the Eurozone, scheduled to be released in a few hours. Moreover, the US Federal Reserve interest rate decision, due to be announced later in the day, will grab a significant amount of investor attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.