For the 24 hours to 23:00 GMT, the GBP fell 0.90% against the USD and closed at 1.5037.

Macroeconomic data showed that UK’s consumer price index (CPI) rose 0.1% YoY in November, in line with market expectations, entering into positive territory for the first time since July 2015. The index had declined by 0.1% in the previous month. Meanwhile, on a monthly basis, the CPI stagnated in November, against expectations for it to decline 0.1%.

Separately, the BoE, in its quarterly bulletin indicated that Britons have improved their finances over the past year and are in a better position to withstand an interest rate hike, thus signalling that the central bank might increase the benchmark rate in 2016.

In the Asian session, at GMT0400, the pair is trading at 1.5053, with the GBP trading 0.11% higher from yesterday’s close.

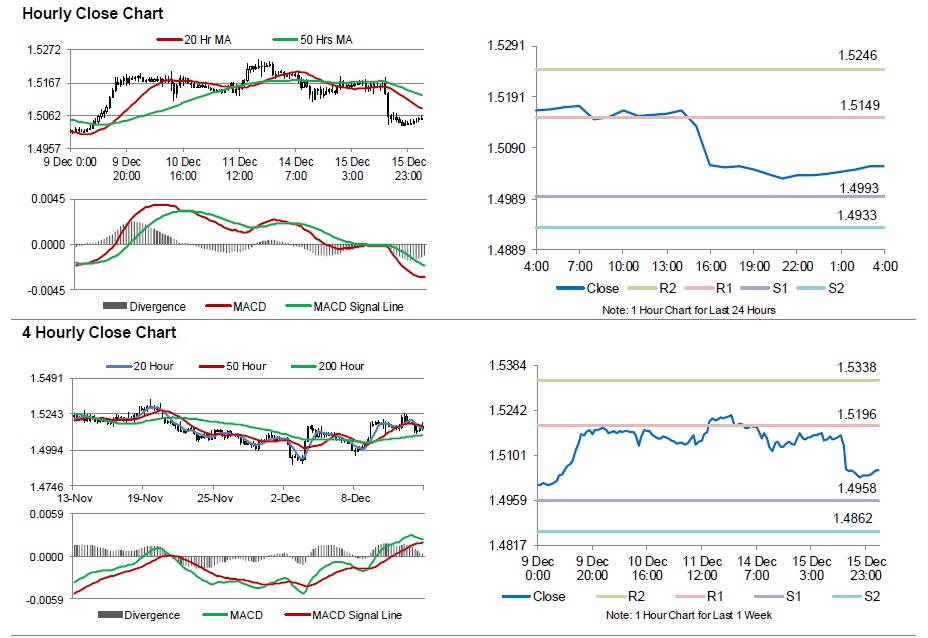

The pair is expected to find support at 1.4993, and a fall through could take it to the next support level of 1.4933. The pair is expected to find its first resistance at 1.5149, and a rise through could take it to the next resistance level of 1.5246.

Going ahead, investors will concentrate on UK’s ILO unemployment rate for October, scheduled to be released in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.