For the 24 hours to 23:00 GMT, the EUR rose 0.13% against the USD and closed at 1.1393, after manufacturing growth in the Euro-zone climbed above expectations in March.

Data showed that the Euro-zone’s final Markit manufacturing PMI rose to a level of 51.6 in March, compared to investor expectations of an advance to 51.4. The preliminary figure had registered a reading of 51.4. Moreover, in Germany, the final manufacturing PMI climbed to a level of 50.7 in March, while investors had expected to remain steady at the preliminary reading of 50.4.

In the US, non-farm payrolls rose more-than-expected to a level of 215.0K in March, compared to a revised increase of 245.0K in the prior month, suggesting that the solid data could allow the cautious Fed to gradually raise interest rate this year. Markets were expecting non-farm payrolls to advance 205.0K. Additionally, average hourly earnings rebounded by 0.3% MoM in March, more than market expectations for a rise of 0.2% and after recording a drop of 0.1% in the previous month. However, the nation’s unemployment rate surprisingly climbed to 5.0% in March, compared to investor expectations of it to remain steady at 4.9%.

In other economic news, the US ISM manufacturing PMI returned to expansion territory by rising more-than-expected to a level of 51.8 in March, from a reading of 49.5 in the prior month. Markets were expecting the index to advance to a level of 50.7. Meanwhile, the final Reuters/Michigan consumer sentiment index fell to a level of 91.0 in the US, higher than market expectations of a drop to a level of 90.5. In the previous month, the index had recorded a reading of 91.7.

In the Asian session, at GMT0300, the pair is trading at 1.1397, with the EUR trading marginally higher from Friday’s close.

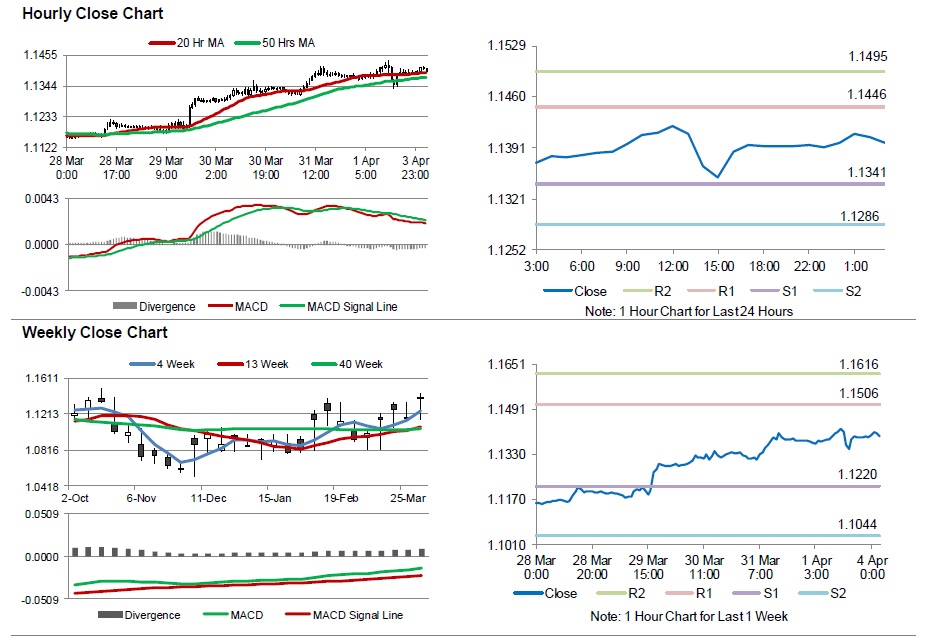

The pair is expected to find support at 1.1341, and a fall through could take it to the next support level of 1.1286. The pair is expected to find its first resistance at 1.1446, and a rise through could take it to the next resistance level of 1.1495.

Going ahead, investors will look forward to the Euro-zone’s unemployment rate and Sentix investor confidence data, scheduled to release in a few hours. Moreover, the US final durable goods orders data for February, due later today, will also attract market attention.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.