For the 24 hours to 23:00 GMT, the GBP fell 0.95% against the USD and closed at 1.4229, after UK’s manufacturing PMI rose less-than-anticipated to a level of 51.0 in March, from a reading of 50.8 in the previous month, suggesting that UK’s economic growth may run out of steam in the first quarter after showing a slight expansion in the previous quarter. Investors had expected it to climb to a level of 51.2. On the other hand, the nation’s seasonally adjusted house prices rose above expectations by 0.8% MoM in March, compared to market expectations of it to increase by 0.4%. House prices had recorded a revised rise of 0.4% in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.4237, with the GBP trading marginally higher from Friday’s close.

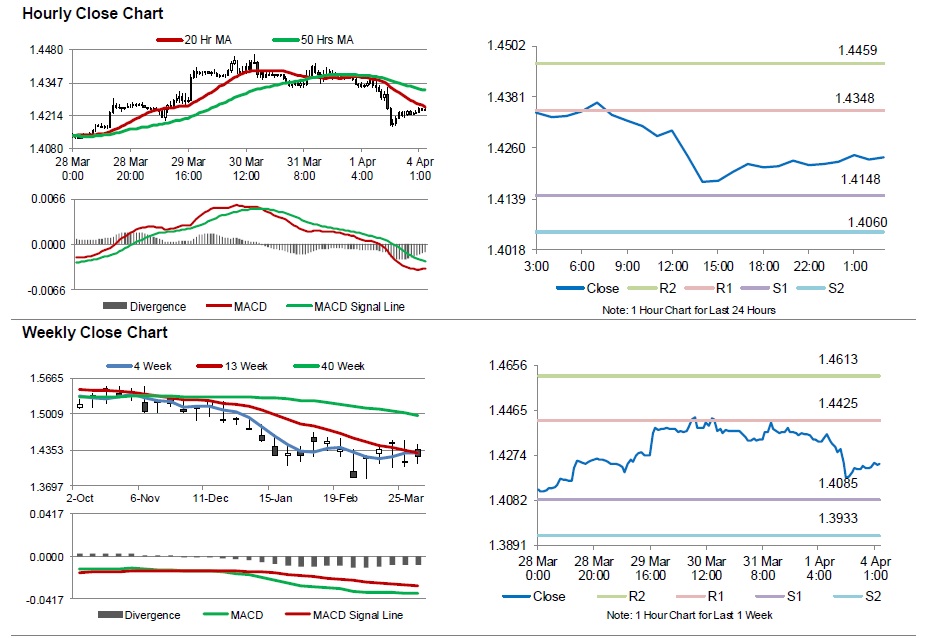

The pair is expected to find support at 1.4148, and a fall through could take it to the next support level of 1.4060. The pair is expected to find its first resistance at 1.4348, and a rise through could take it to the next resistance level of 1.4459.

Going ahead, market participants will look forward to the release of UK’s Markit construction PMI data for March, due in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.