For the 24 hours to 23:00 GMT, the EUR rose 0.98% against the USD and closed at 1.1203, after the ECB President, Mario Draghi, stated that the central bank is not ready to give up against low inflation and added that global forces are devising to hold inflation down. He also hinted that adopting a wait-and-see policy has risks, which may lead to persistently weaker inflation. Separately, the European Commission trimmed the Euro-zone 2016 growth forecast to 1.7% from its earlier prediction of 1.8%, warning that the slowdown in China and the ongoing migrant crisis could affect the economy.

In other economic news, Germany’s construction PMI data advanced at the fastest pace in nearly five years to a level of 57.9 in January, from a level of 55.5 registered in the previous month.

In the US, initial jobless claims rose more than anticipated to a six-month high level of 285.0K in the week ended 30 January, suggesting that the nation’s labour market lost some steam amid the economic slowdown. Meanwhile, markets expected it to rise to a level of 278.0K and compared to a revised reading of 277.0K in the previous week. Additionally, the nation’s factory orders fell more than expected by 2.9% in December, following a revised fall of 0.7% in the previous month and compared to investor expectations for a drop of 2.8%. Additionally, final durable goods orders declined more than anticipated by 5.0% in December, compared to a drop of 5.1% in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.1199, with the EUR trading marginally lower from yesterday’s close.

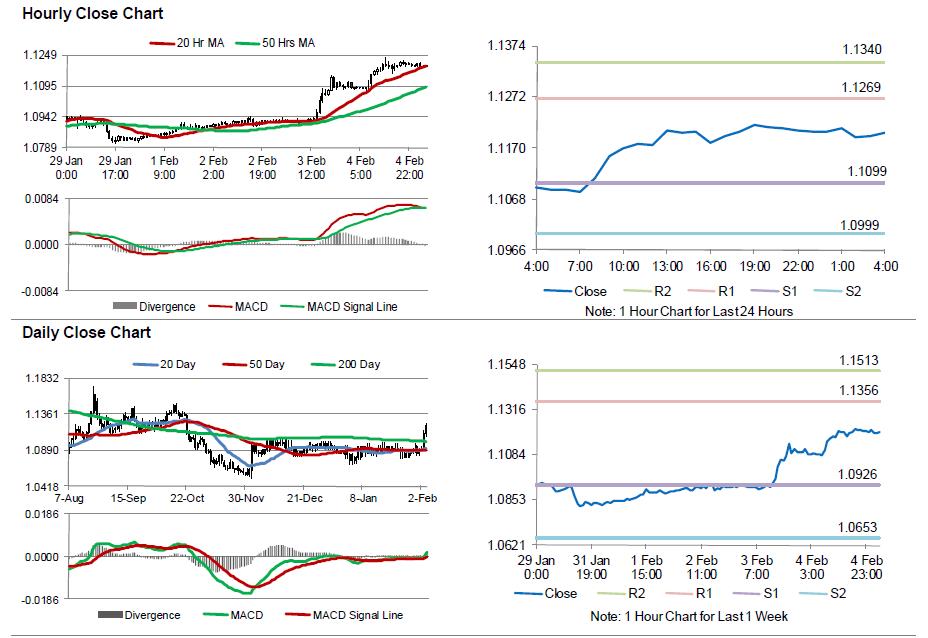

The pair is expected to find support at 1.1099, and a fall through could take it to the next support level of 1.0999. The pair is expected to find its first resistance at 1.1269, and a rise through could take it to the next resistance level of 1.1340.

Going ahead, investors await the release of Germany’s seasonally adjusted factory orders data for December, slated to release in a few hours. Additionally, the US non-farm payrolls and unemployment rate data for January, due later today, will attract a lot of market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.