For the 24 hours to 23:00 GMT, the GBP declined 0.12% against the USD and closed at 1.4579.

Yesterday, the BoE policymakers unanimously voted to keep key interest rate steady at 0.5%, and made no changes to its £375.0 billion asset purchase program, in line with market expectations. In his post meeting speech, the BoE Governor, Mark Carney, stated that weaker inflation and modest growth outlook caused the central bank to take this decision, suggesting that prospects of a rate hike in the UK are getting further and further into the future. He further added that economic growth in the nation is affected by the ongoing turmoil in global financial markets and slowdown in Chinese economy has posed a downside risk to the economy in the near future. Additionally, the BoE in its latest inflation report, cut UK’s growth forecast to 2.2% in 2016 and 2.3% in 2017, down from its earlier forecast of 2.5% and 2.6% respectively.

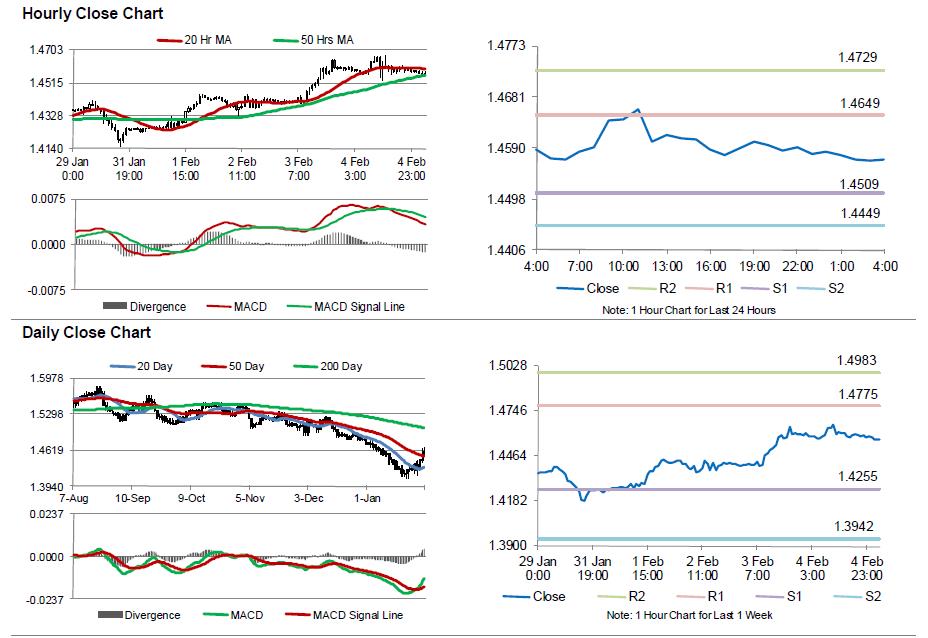

In the Asian session, at GMT0400, the pair is trading at 1.4568, with the GBP trading 0.07% lower from yesterday’s close.

The pair is expected to find support at 1.4509, and a fall through could take it to the next support level of 1.4449. The pair is expected to find its first resistance at 1.4649, and a rise through could take it to the next resistance level of 1.4729.

Amid no macroeconomic releases in UK today, investors will look forward to UK’s total trade balance, industrial production and the NIESR GDP estimate data, all scheduled to release next week.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.