For the 24 hours to 23:00 GMT, the EUR rose 0.29% against the USD and closed at 1.0899.

In economic news, Germany’s GfK consumer confidence index remained steady at 9.4 points in February.

The greenback lost ground after the US Federal Reserve kept interest rate unchanged at 0.5%. In a statement issued after the meeting, the FOMC indicated that it was closely monitoring global economic and financial developments, but did not rule out a rate hike in March. Further, the Fed pointed out that the US economy is still on track for moderate growth with improving labour conditions and expressed concern about low inflation levels due to the ongoing oil price plunge.

In other economic news, US new home sales jumped 10.8% MoM in December, its strongest pace in 10 months, reaching an annualized level of 544.0K, higher than market expectations for a reading of 500.0K. In the previous month, new home sales had registered a revised level of 491.0K. Additionally, the nation’s MBA mortgage applications rose for the third consecutive week by 8.8% in the week ended 22 January, following a gain of 9.0% in the previous week.

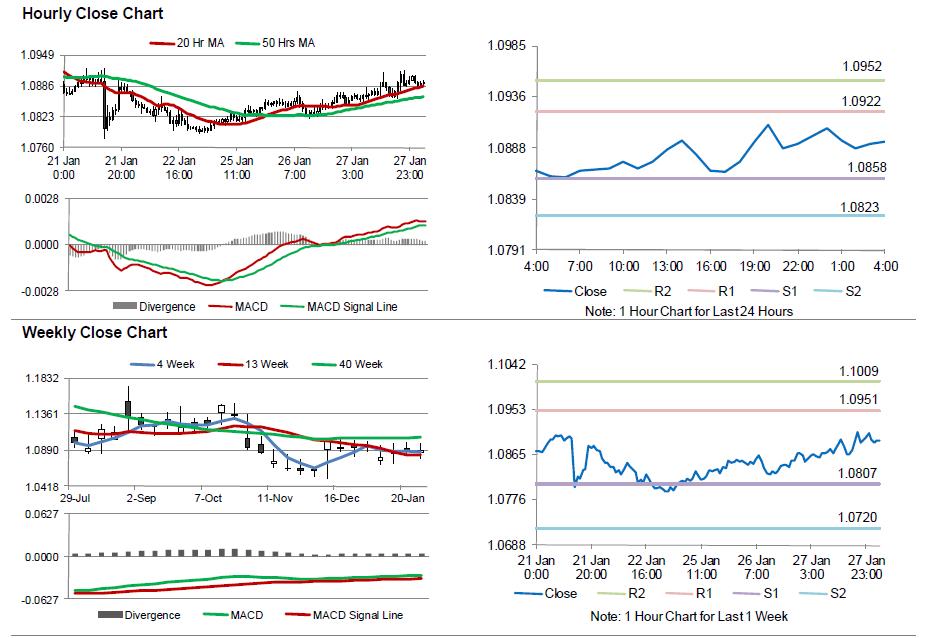

In the Asian session, at GMT0400, the pair is trading at 1.0893, with the EUR trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.0858, and a fall through could take it to the next support level of 1.0823. The pair is expected to find its first resistance at 1.0922, and a rise through could take it to the next resistance level of 1.0952.

Going ahead, investors will look forward to the Euro-zone’s final consumer confidence and business climate indicator data, both for January, slated to be released in a few hours. Additionally, Germany’s preliminary consumer price index and the US initial jobless claims data, due later in the day, will also grab market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.