For the 24 hours to 23:00 GMT, the GBP declined 0.71% against the USD and closed at 1.4244, after downbeat UK mortgage data.

The nation’s BBA mortgage approvals unexpectedly declined to a seven-month low level of 43.96K in December while markets expected it to advance to a level of 45.50K, following a reading of 44.53K in the preceding month.

Other economic data showed that UK’s seasonally adjusted nationwide house price index advanced less than expected by 0.3% MoM in January, after recording a gain of 0.8% in the previous month and compared to market expectations of a gain of 0.6%.

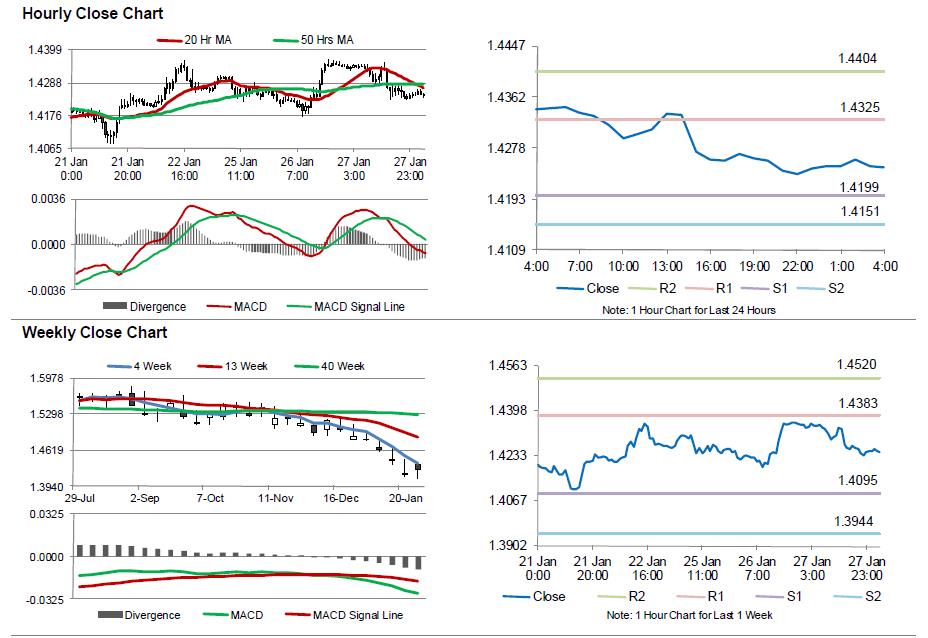

In the Asian session, at GMT0400, the pair is trading at 1.4246, with the GBP trading marginally higher from yesterday’s close.

The pair is expected to find support at 1.4199, and a fall through could take it to the next support level of 1.4151. The pair is expected to find its first resistance at 1.4325, and a rise through could take it to the next resistance level of 1.4404.

Moving ahead, market participants will keep a close watch on UK’s crucial GDP data, due in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.