For the 24 hours to 23:00 GMT, the EUR declined 0.37% against the USD and closed at 1.1276, after German producer price index declined more-than-expected by 0.5% MoM in February, following a 0.7% fall in the previous month. Markets were anticipating the producer price index to ease 0.1%. Additionally, the ECB’s Executive Board member, Peter Praet, indicated that the central bank could take interest rates even lower, if the Euro-zone economy fails to pick up.

In the US, the flash Reuters/Michigan consumer sentiment index surprisingly fell to a level of 90.0 in March, compared to a reading of 91.7 in the prior month, while investors were anticipating the index to advance to a level of 92.2.

Separately, the St. Louis Fed President, James Bullard, stated that the central bank’s inflation and employment goals have been achieved and that an increase in interest rates is justified.

In the Asian session, at GMT0400, the pair is trading at 1.1275, with the EUR trading marginally lower from Friday’s close.

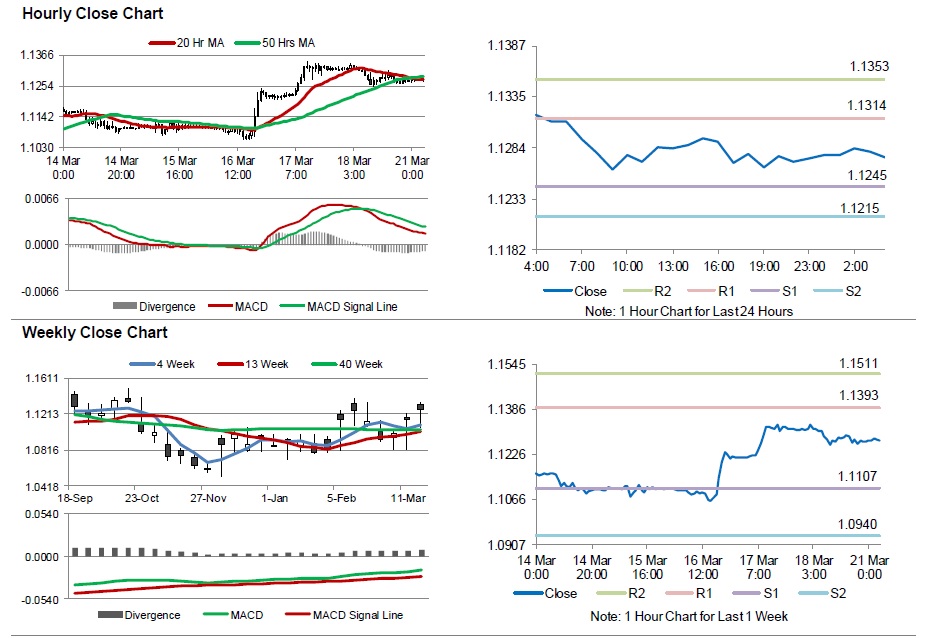

The pair is expected to find support at 1.1245, and a fall through could take it to the next support level of 1.1215. The pair is expected to find its first resistance at 1.1314, and a rise through could take it to the next resistance level of 1.1353.

Moving ahead, investors look forward to the Eurozone’s preliminary consumer confidence index data for March, scheduled to release later in the day. Moreover, US existing home sales and the Chicago Fed national activity index data, both for the month of February, due later today, will also attract market attention.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.