For the 24 hours to 23:00 GMT, the GBP marginally rose against the USD and closed at 1.4474.

The Bank of England (BoE), in its quarterly bulletin, indicated that a slowdown in China could have spill-over effects on Britain, due to UK’s increased trade links with the nation. Additionally, the central bank mentioned that, the uncertainty surrounding Britain’s June 23 referendum has contributed to recent declines in the Pound.

In the Asian session, at GMT0400, the pair is trading at 1.4446, with the GBP trading 0.19% lower from Friday’s close.

Early this morning, data showed that UK’s Rightmove house price index recorded a rise of 1.3% MoM in March, following a rise of 2.9% in the previous month.

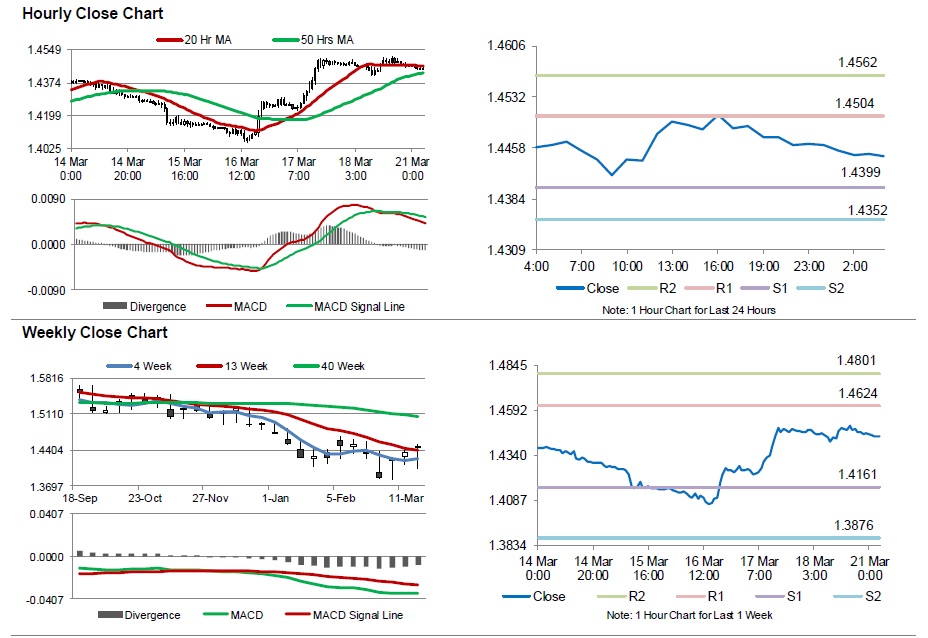

The pair is expected to find support at 1.4399, and a fall through could take it to the next support level of 1.4352. The pair is expected to find its first resistance at 1.4504, and a rise through could take it to the next resistance level of 1.4562.

Going ahead, investors will look forward to the UK’s consumer price index and public sector net borrowing data, both for the month of February, scheduled to release tomorrow.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.