For the 24 hours to 23:00 GMT, EUR declined 0.73% against the USD and closed at 1.3665, amid a broad strength in the greenback.

However, losses in the Euro-zone’s single currency were capped after Markit Economics reported that its manufacturing PMI in the region rose to a reading of 52.7 in December, in-line with market estimates and compared to a level of 51.6 registered in the preceding month. Germany’s Markit manufacturing PMI advanced more-than-expected to a level of 54.3 in December, from previous month’s reading of 52.7.

Meanwhile, in the US, an official report showed that initial jobless claims in the nation unexpectedly declined to a reading of 339,000 during the week ended December 27, from a level of 341,000 recorded in the preceding week. Separately, another report revealed that the US Markit manufacturing PMI rose at the fastest pace in 11 months to a reading of 55.0 in December, from a reading of 54.7 witnessed in November. However, the ISM manufacturing PMI in the US declined in line with analysts’ estimates, to a level of 57.0 in December, following the previous month’s reading of 57.3.

In the Asian session, at GMT0400, the pair is trading at 1.3662, with the EUR trading tad lower from yesterday’s close.

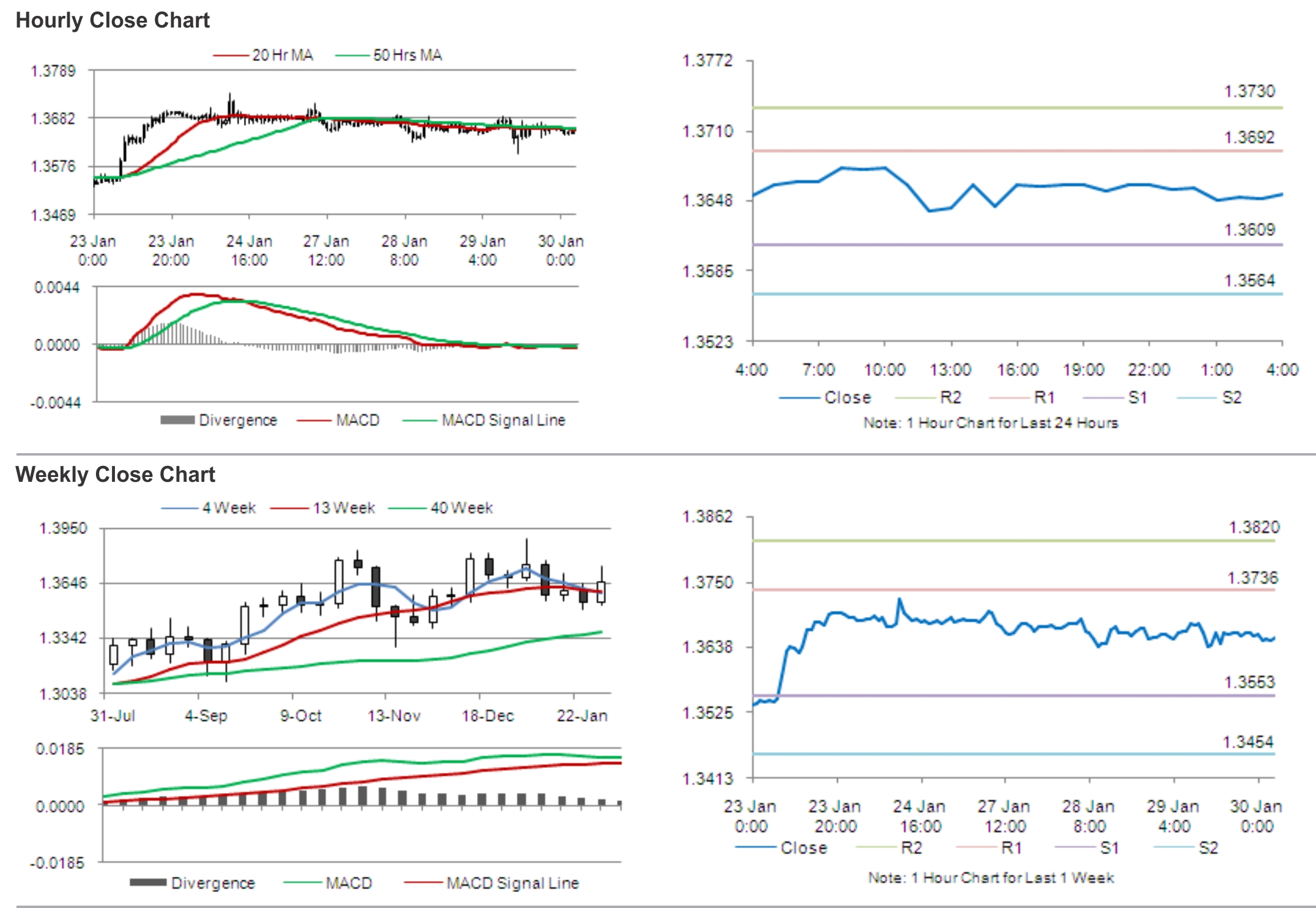

The pair is expected to find support at 1.3603, and a fall through could take it to the next support level of 1.3543. The pair is expected to find its first resistance at 1.3747, and a rise through could take it to the next resistance level of 1.3831.

Later today, the European Central Bank (ECB) is expected to release a report on the region’s M3 money supply and private loans data for the month of November.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.