For the 24 hours to 23:00 GMT, GBP fell 0.77% against the USD and closed at 1.6449, as risk-appetite among investors reduced after Markit Economics reported that UK’s manufacturing PMI declined to a level of 57.3 in December, worse than market expectations for a fall to 58.0, from the previous level of 58.1.

In the Asian session, at GMT0400, the pair is trading at 1.6441, with the GBP trading marginally lower from yesterday’s close.

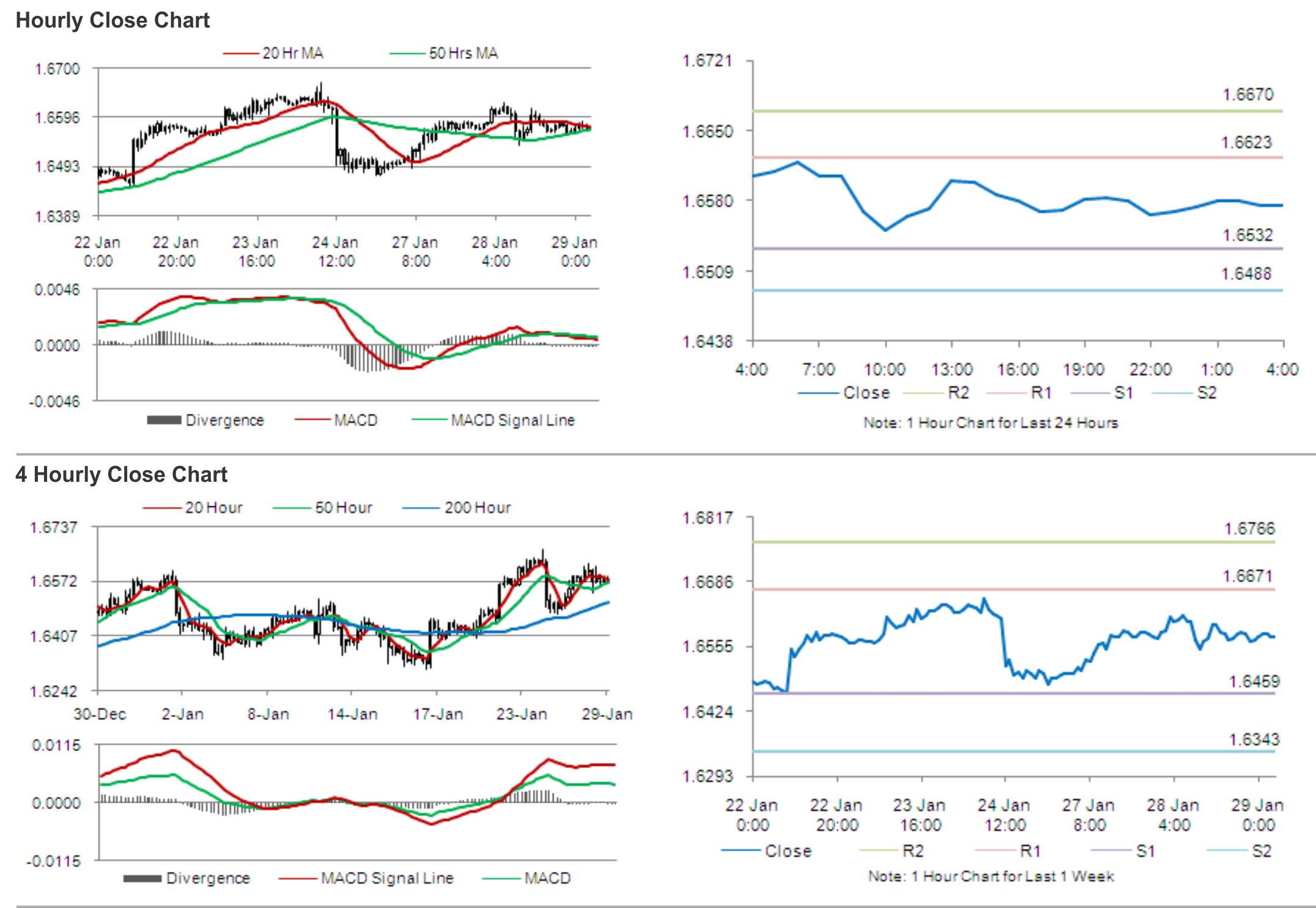

The pair is expected to find support at 1.6367, and a fall through could take it to the next support level of 1.6292. The pair is expected to find its first resistance at 1.6560, and a rise through could take it to the next resistance level of 1.6678.

Market participants are expected to keep a close watch on UK’s construction PMI data, Nationwide’s housing prices report and the Bank of England’s (BoE) mortgage approval data, slated for release later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.