For the 24 hours to 23:00 GMT, EUR rose 0.15% against the USD and closed at 1.3775, reversing its initial losses, triggered by an official report that showed annual consumer inflation rate in the Euro-zone declined to 0.5% in March, more than market expectations calling for a fall to 0.6%, from previous month’s level of 0.7%. However, positive sentiment for the Euro-zone’s common currency was fuelled after an ECB policymaker, Ewald Nowotny opined that recession in the Euro-zone had come to an end and that the economy has shown a significant improvement despite some prevailing economic problems. Adding to the positive sentiment, retail sales in Germany unexpectedly advanced 1.3% (MoM) in February while France GDP rose 0.3% (QoQ) in-line with analysts’ estimates for the fourth quarter.

Meanwhile, the US Dollar lost ground after the Fed Chief, Janet Yellen defended the central bank’s easy-money policies by stating that the world’s biggest economy would need monetary stimulus “for some time” to eradicate the current slackness in the US jobs markets. She further added that even if the central bank phases out its monthly bond purchases later this year, it may not raise its key short-term rate anytime soon, in order to stimulate borrowing, spending and economic growth.

On the economic front, the Chicago purchasing managers’ index fell more-than-expected to an 8-month low reading of 55.9 in March, from a level of 59.8 registered in the previous month. However, the Dallas Fed manufacturing business index jumped to a reading of 4.9 in March from a figure of 0.3 in February.

In the Asian session, at GMT0300, the pair is trading at 1.3775, with the EUR trading flat from yesterday’s close.

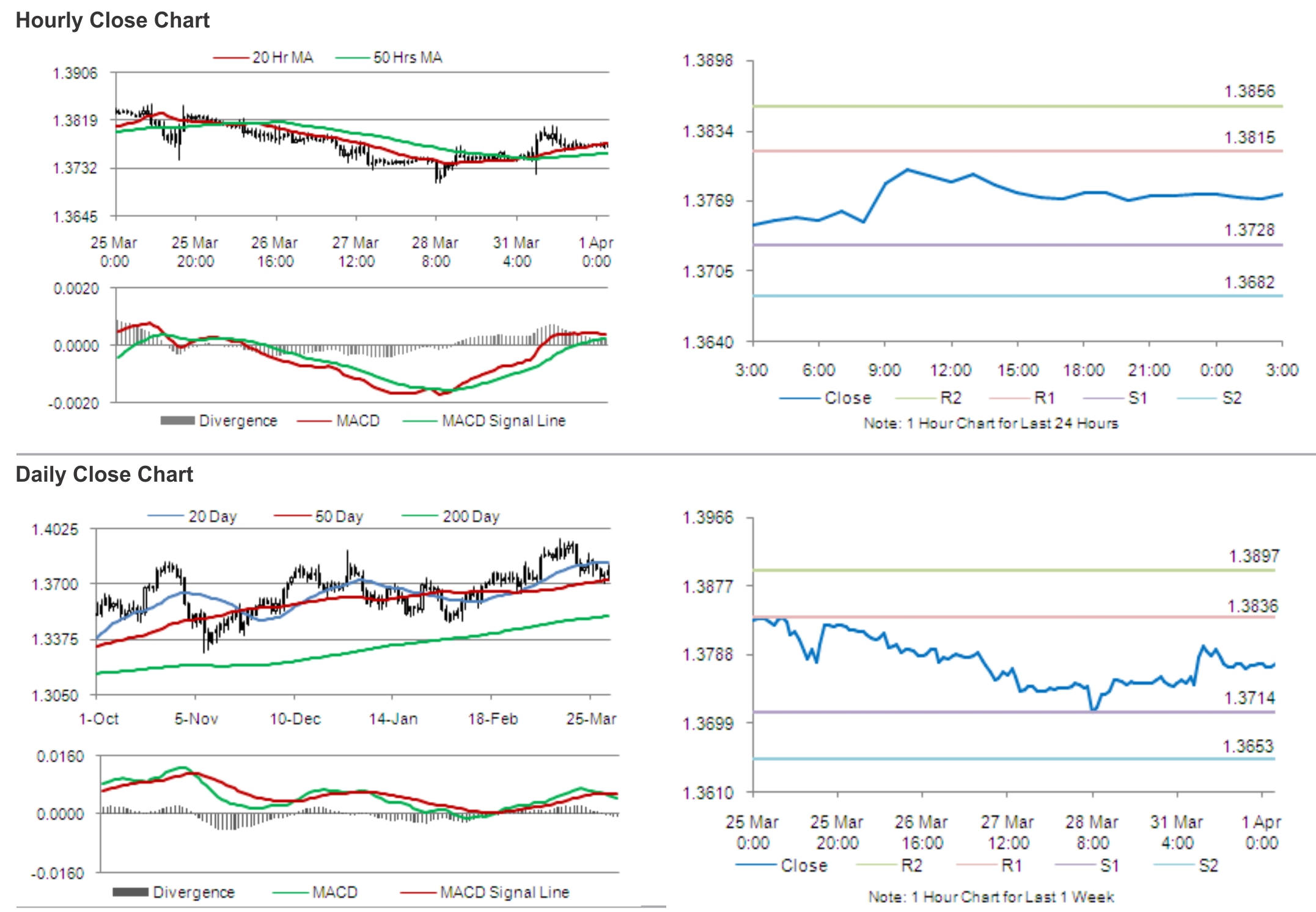

The pair is expected to find support at 1.3728, and a fall through could take it to the next support level of 1.3682. The pair is expected to find its first resistance at 1.3815, and a rise through could take it to the next resistance level of 1.3856.

Looking forwards, Euro-zone’s Markit manufacturing PMI and unemployment data, along with Germany’s unemployment rate data would fetch traders’ attention. Furthermore, later today the ISM manufacturing PMI report from the US would attract attention from investors.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.