For the 24 hours to 23:00 GMT, GBP rose 0.10% against the USD and closed at 1.6665.

The US Dollar came under pressure, following the Fed Chief, Janet Yellen’s dovish comments on the prevailing conditions in the US jobs markets.

In the UK, the Bank of England (BoE) Governor and Financial Stability Board Chairman, Mark Carney highlighted the need for banks and regulators to continue safeguarding the nation’s financial system even as the outlook on global economic recovery continues to improve.

Yesterday, the British Pound lost ground for a brief period of time, after the BoE reported that mortgage approvals in the UK economy fell to a level of 70,309 in February, more than market estimates and compared to 76,753 mortgage approvals in the previous month. Separately, net consumer credit in the UK rose less-than-expected by £0.55 billion in February, following a revised rise of £0.62 billion recorded in the prior month. Separately, other data revealed that the net lending to individuals rose by £2.3 billion in February, compared to a rise of £2.1 billion recorded in the preceding month.

Yesterday, the BoE’s Deputy Governor of Prudential Regulation, Andrew Bailey indicated that the UK financial system at present is quite stable and grounded, largely due to last year’s actions on re-capitalisation of banks. He further added that the nation’s banking sector would witness few set of stress tests this year, specially formulated to examine whether the UK lenders’ capital buffers are strong enough to withstand shocks resulting from the future higher interest rate environment.

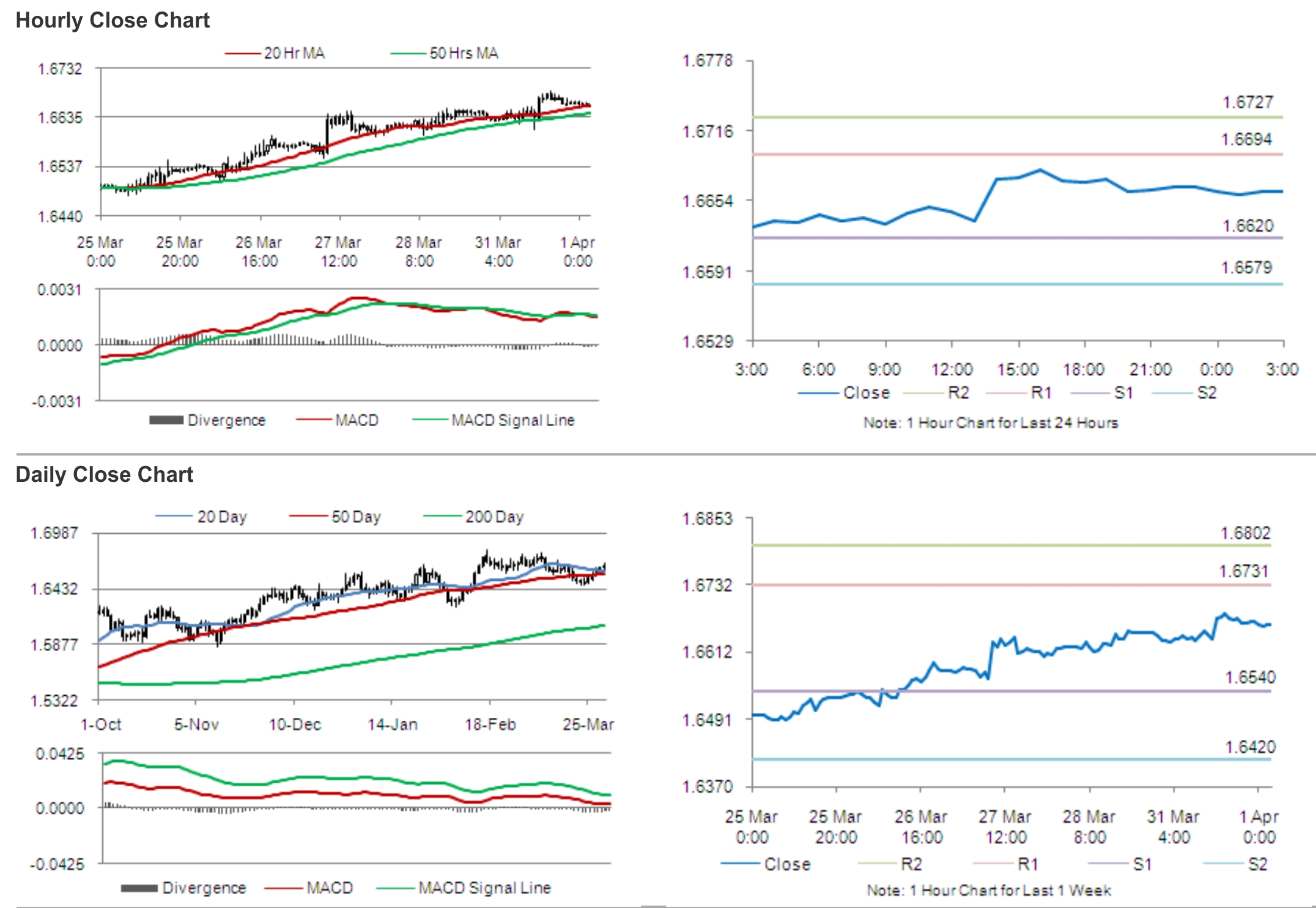

In the Asian session, at GMT0300, the pair is trading at 1.6661, with the GBP trading tad lower from yesterday’s close.

The pair is expected to find support at 1.6620, and a fall through could take it to the next support level of 1.6579. The pair is expected to find its first resistance at 1.6694, and a rise through could take it to the next resistance level of 1.6727.

Market participants are expected to keep a tab on UK’s Markit manufacturing PMI data, slated for release later today.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.