For the 24 hours to 23:00 GMT, the EUR declined 0.07% against the USD and closed at 1.1005.

In economic news, the Euro-zone’s preliminary GDP expanded by 0.3% QoQ, at par with market expectations in 4Q 2015, mainly driven by robust investment spending. Additionally, Germany’s seasonally adjusted industrial production rebounded above expectations to a six-year high level of 3.3% MoM in January, compared to a revised fall of 0.3% in the previous month. Market expectation was for industrial production to rise 0.5%.

In the US, the NFIB small business optimism index unexpectedly fell to a level of 92.9 in February, hitting its lowest level in two years, compared to market expectations for an advance to a level of 94.1 and after recording a reading of 93.9 in the preceding month.

In the Asian session, at GMT0400, the pair is trading at 1.0974, with the EUR trading 0.28% lower from yesterday’s close.

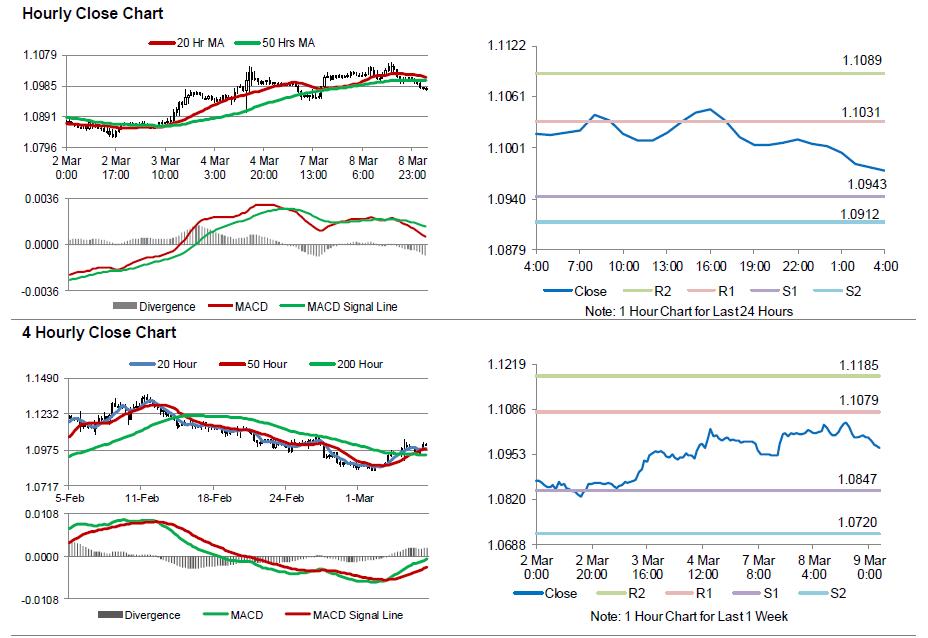

The pair is expected to find support at 1.0943, and a fall through could take it to the next support level of 1.0912. The pair is expected to find its first resistance at 1.1031, and a rise through could take it to the next resistance level of 1.1089.

Amid no major economic releases in the Euro-zone today, investors will look forward to the US MBA mortgage applications data, scheduled to be released later in the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.