For the 24 hours to 23:00 GMT, the GBP declined 0.37% against the USD and closed at 1.4209.

Yesterday, the BoE Governor, Mark Carney, warned that the possibility of Britain leaving the European Union would trigger a prolonged period of financial instability and that the central bank will do everything in its capacity to achieve monetary and financial stability in the country.

In the Asian session, at GMT0400, the pair is trading at 1.4184, with the GBP trading 0.18% lower from yesterday’s close.

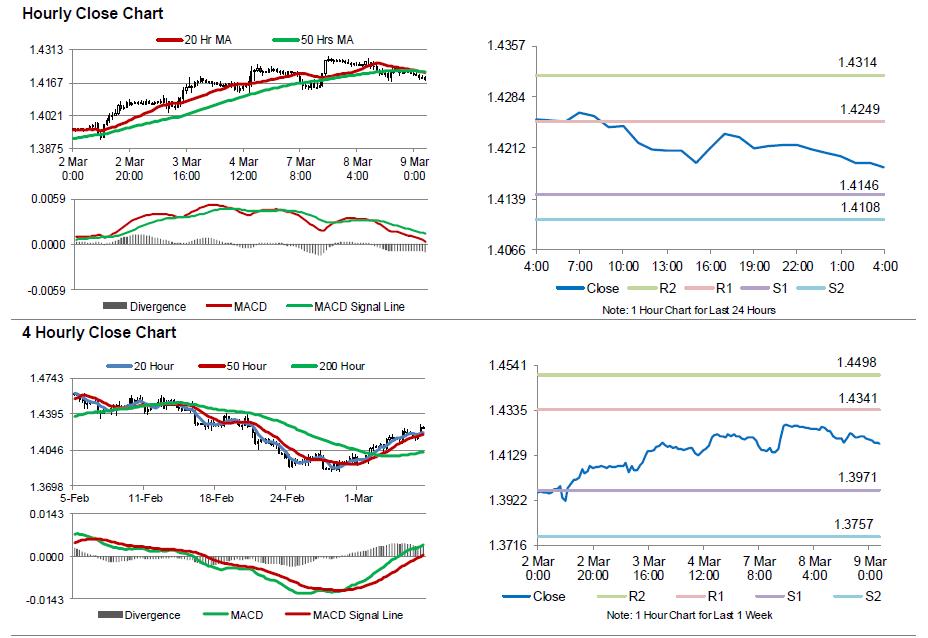

The pair is expected to find support at 1.4146, and a fall through could take it to the next support level of 1.4108. The pair is expected to find its first resistance at 1.4249, and a rise through could take it to the next resistance level of 1.4314.

Going ahead, market participants await the release of UK’s industrial and manufacturing production data, scheduled to release in a few hours. Moreover, the nation’s NIESR GDP estimate data, due later in the day, will also attract a significant amount of investor attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.