For the 24 hours to 23:00 GMT, the EUR declined 0.73% against the USD and closed at 1.1171, on the back of downbeat economic data across the Euro-zone.

Data released showed that the Euro-zone’s slipped back into deflation territory, after the region’s inflation slid 0.1% on an annual basis in September, compared to a similar rise recorded in the previous month, thus mounting pressure on the ECB to rethink about its existing €1.1 trillion stimulus programme in order to kick start anaemic price growth.

Other economic data indicated that the Euro-zone’s unemployment rate unexpectedly remained unchanged at 11.0% in August, as market participants were expecting it to drop to 10.9%.

Elsewhere, in Germany, unemployment rate remained steady at 6.4% in September, matching market expectations, while the German retail sales dipped 0.4% MoM in August, confounding market expectations for a 0.2% increase and after witnessing an upwardly revised gain of 1.6% in August.

The greenback traded on a firmer footing, after the US private sector companies topped market forecasts for job creation. Data showed that private companies added 200,000 jobs in September, surpassing consensus estimates of an addition of 190,000 jobs. In the previous month, private payroll gains were revised down to 186,000.

In other economic news, the Chicago PMI fell to 48.7 in September, compared with expectations of 53.0 and down sharply from 54.4 reported in the preceding month.

In the Asian session, at GMT0300, the pair is trading at 1.1165, with the EUR trading a tad lower from yesterday’s close.

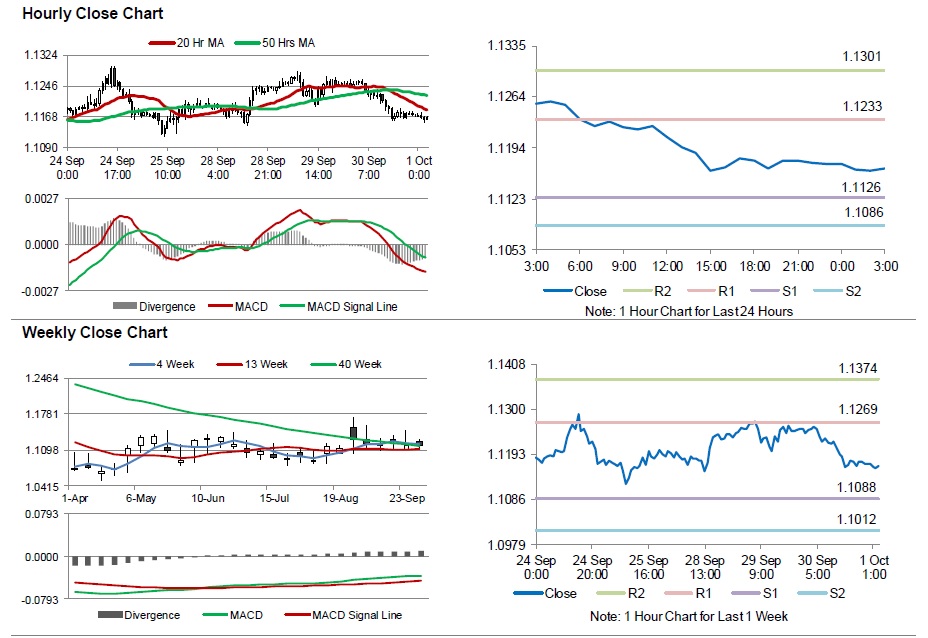

The pair is expected to find support at 1.1126, and a fall through could take it to the next support level of 1.1086. The pair is expected to find its first resistance at 1.1233, and a rise through could take it to the next resistance level of 1.1301.

Trading trends in the Euro today are expected to be determined by the manufacturing PMI data from the Euro-zone and its peripheries, set for release in a few hours. Additionally, the US ISM manufacturing PMI and initial jobless claims data, scheduled later today would also grab lot of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.