For the 24 hours to 23:00 GMT, the GBP fell 0.21% against the USD and closed at 1.5126, as UK GDP numbers could not provide any surprise.

Data showed that Britain’s economy grew at a seasonally adjusted rate of 0.7% in Q2, inline market forecasts and its preliminary figure, however its yearly rate was revised lower to 2.4%, from the initial estimate of 2.6%. Meanwhile, the nation’s total business investment rose 1.6% in the second quarter, compared to a previous estimate of 2.9%, while the index of services print for the three months ended July grew 0.8%, from 0.7% rise registered in the earlier 3-month period.

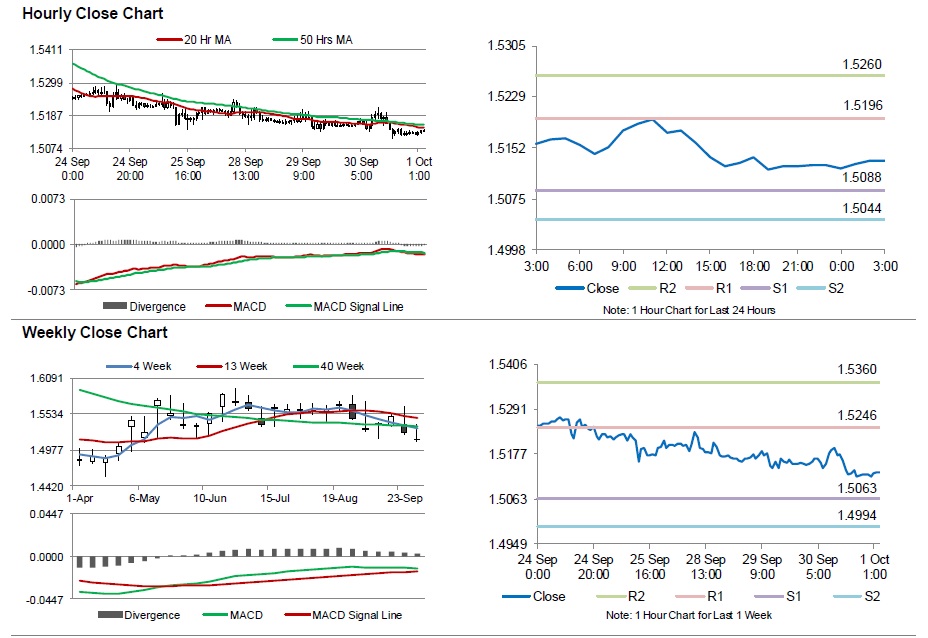

In the Asian session, at GMT0300, the pair is trading at 1.5132, with the GBP trading marginally higher from yesterday’s close.

The pair is expected to find support at 1.5088, and a fall through could take it to the next support level of 1.5044. The pair is expected to find its first resistance at 1.5196, and a rise through could take it to the next resistance level of 1.5260.

Moving ahead, investors will look forward to Britain’s PMI manufacturing data for September, scheduled in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.