For the 24 hours to 23:00 GMT, the EUR declined 0.50% against the USD and closed at 1.1349.

Data indicated that the Euro-zone’s seasonally adjusted flash gross domestic product (GDP) advanced 0.4% on a quarterly basis in 2Q 2018, more than the initial estimate of 0.3% and beating market expectations for a rise of 0.3%. In the previous quarter, GDP had recorded a similar rise. On the other hand, the region’s seasonally adjusted industrial production retreated 0.7% on a monthly basis in June, driven by a collapse in machinery and equipment investment and more than market expectations for a drop of 0.4%. In the prior month, industrial production had recorded a revised climb of 1.4%. Meanwhile, the economic sentiment index improved to -11.1 in August, compared to a reading of -18.7 in the prior month.

Separately, in Germany, seasonally adjusted preliminary gross domestic product (GDP) rose 0.5% on a quarterly basis in 2Q 2018, driven by consumption and state spending and beating market expectations for a rise of 0.4%. In the prior quarter, GDP had recorded a revised rise of 0.4%. Moreover, the nation’s final consumer price index (CPI) climbed 2.0% on an annual basis in July, in line with market expectations and confirming the preliminary print. In the previous month, the consumer price index had climbed 2.1%.

Additionally, in Germany, the ZEW economic sentiment index surged to a level of -13.7 in August, compared to a level of -24.7 in the prior month. Further, the current situation index unexpectedly rose to a level of 72.6 in August, defying market expectations for a fall to a level of 72.1. In the prior month, the index had registered a level of 72.4.

In the US, data showed that US small business optimism index surprisingly advanced to a level of 107.9 in July, following market expectations for a decline to a level of 106.8. The index had registered a level of 107.2 in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.1325, with the EUR trading 0.21% lower against the USD from yesterday’s close.

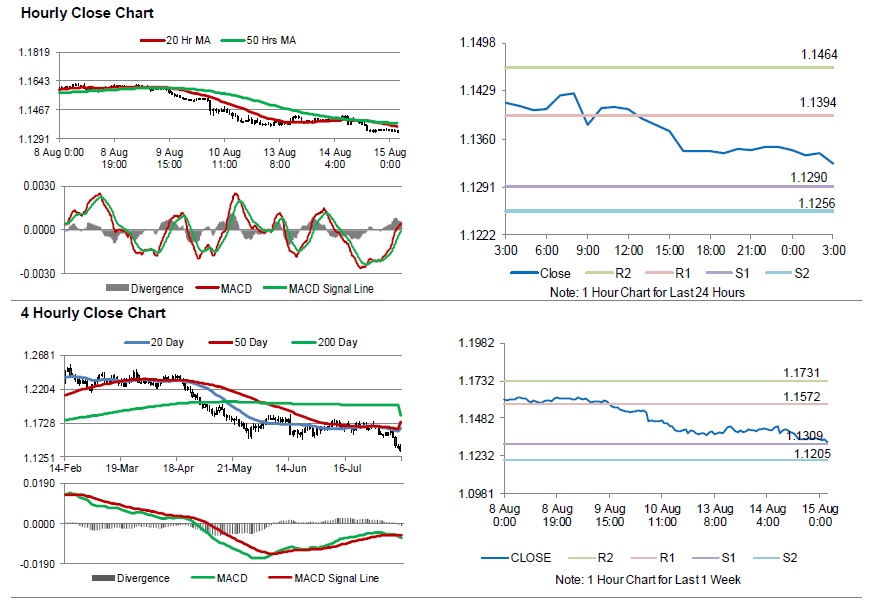

The pair is expected to find support at 1.1290, and a fall through could take it to the next support level of 1.1256. The pair is expected to find its first resistance at 1.1394, and a rise through could take it to the next resistance level of 1.1464.

Amid no major economic releases in the Euro-zone today, investor would focus on the US MBA mortgage applications followed by retail sales, industrial production, manufacturing production and capacity utilisation, all for June, slated to release later in the day. Additionally, the NY Empire State manufacturing index and the NAHB housing market index, both for August, along with business inventories for June, will keep investors on their toes.

The currency pair is trading below its 20 Hr and 50 Hr moving average.