For the 24 hours to 23:00 GMT, the GBP declined 0.37% against the USD and closed at 1.2720.

On the data front, UK’s ILO unemployment rate unexpectedly fell to a rate of 4.0% in the April-June 2018 period, marking its lowest rate since February 1975. In the March-May 2018 period, the ILO unemployment rate had recorded a reading of 4.2%. Average earnings including bonus rose 2.4% on an annual basis in the April-June 2018 period, undershooting market expectations for a rise of 2.5%. Average earnings rose 2.5% in the March-May 2018 period. Meanwhile, claimant count rate remained steady at 2.5% in July.

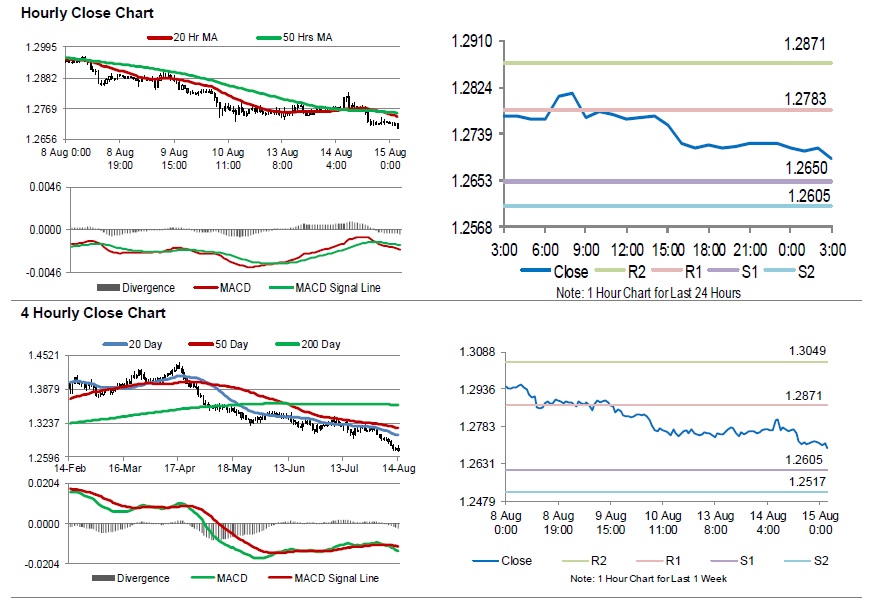

In the Asian session, at GMT0300, the pair is trading at 1.2694, with the GBP trading 0.20% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.2650, and a fall through could take it to the next support level of 1.2605. The pair is expected to find its first resistance at 1.2783, and a rise through could take it to the next resistance level of 1.2871.

Moving ahead, all eyes would be on UK’s consumer price index, producer price index, retail price index, all for July, slated to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.