For the 24 hours to 23:00 GMT, the EUR rose marginally against the USD and closed at 1.1243, after the Euro-zone’s consumer price index (CPI) climbed 0.1% on a monthly basis in August, meeting market expectations and following a drop of 0.6% in the previous month. Meanwhile, the final CPI was confirmed at 0.2% on an annual basis in August, in line with market expectations and after registering a similar rise in the prior month. On the other hand, the region’s seasonally adjusted trade surplus narrowed for the third straight month, after it fell to a level of €20.0 billion in July, amid a drop in exports. Meanwhile, markets had envisaged the region to post a trade surplus of €22.0 billion, after recording a revised trade surplus of €23.8 billion in the prior month.

The US Dollar lost ground against its key counterparts, after a spate of lacklustre US economic reports stoked worries about the strength of the world’s largest economy.

Data revealed that the US advance retail sales fell by 0.3% in August, dropping for the first time in five-months, following a revised gain of 0.1% in the previous month. Further, the nation’s industrial production slid more-than-expected by 0.4% in August, compared to investor consensus for a drop of 0.2% and following a revised gain of 0.6% in the prior month. Moreover, the manufacturing production eased more-than-anticipated by 0.4% MoM in August, following a revised rise of 0.4% in the prior month.

In other economic news, US business inventories remained flat on a monthly basis in July, against an advance of 0.2% in the previous month. On the other hand,, the nation’s initial jobless claims rose less-than-expected to a level of 260.0K in the week ended 10 September 2016, compared to investor consensus for a rise to a level of 265.0K and following a reading of 259.0K in the prior week.

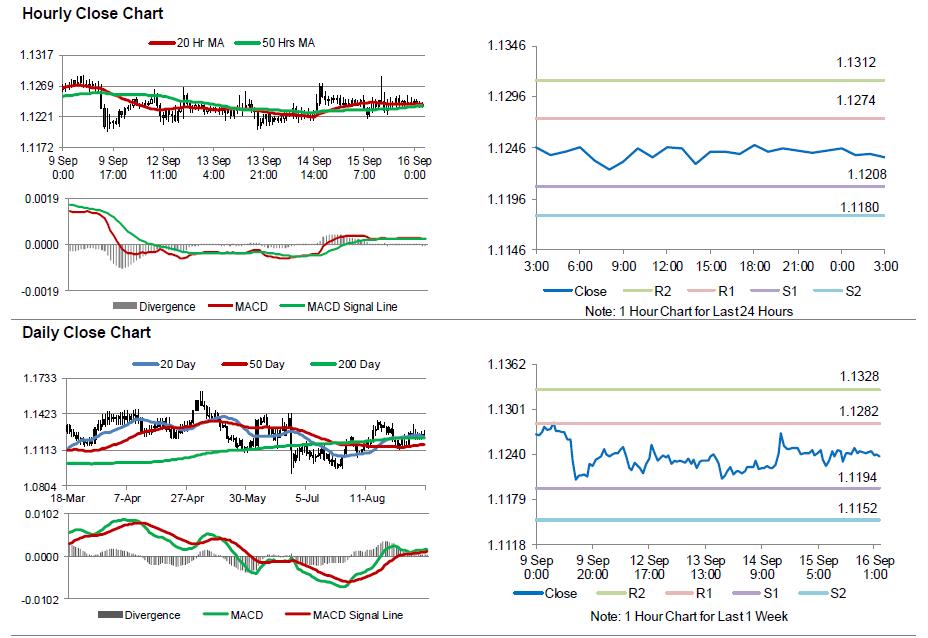

In the Asian session, at GMT0300, the pair is trading at 1.1237, with the EUR trading a tad lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1208, and a fall through could take it to the next support level of 1.1180. The pair is expected to find its first resistance at 1.1274, and a rise through could take it to the next resistance level of 1.1312.

Amid no major economic releases in the Euro-zone today, investors would closely monitor the US consumer price index and flash Reuters/Michigan consumer confidence index data, due to release later today.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.