For the 24 hours to 23:00 GMT, the GBP declined slightly against the USD and closed at 1.3243, after the Bank of England (BoE), in its latest monetary policy meeting, maintained the benchmark interest rate steady and hinted that another rate cut could be introduced later this year.

The BoE kept the key interest rate at 0.25%, in line with market expectations. The central bank also left the size of its quantitative easing programme unchanged at £435.0 billion and would continue to purchase up to £10.0 billion worth of corporate bonds. Further, the central bank’s summary report indicated that the recent economic data is encouraging and the committee will closely monitor the probable longer-term repercussions of the historic Brexit vote along with forthcoming reports at the November forecast and if the assessment at that time is seen as broadly consistent with its August inflation report, then a rate cut could be introduced to support a weakening economy.

In other economic news, UK’s retail sales fell less-than-expected by 0.2% MoM in August, compared to a revised advance of 1.9% in the previous month.

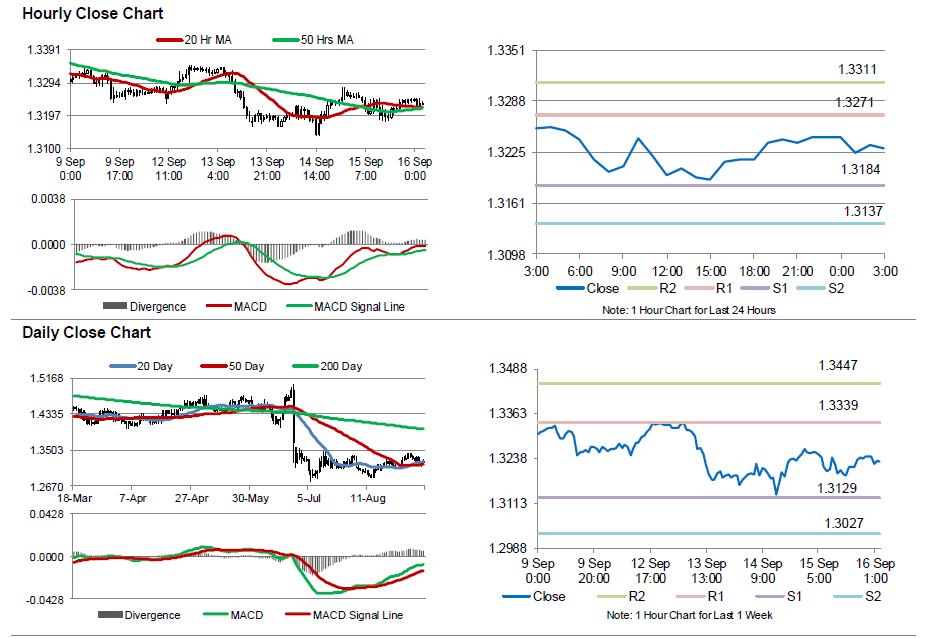

In the Asian session, at GMT0300, the pair is trading at 1.3230, with the GBP trading 0.1% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.3184, and a fall through could take it to the next support level of 1.3137. The pair is expected to find its first resistance at 1.3271, and a rise through could take it to the next resistance level of 1.3311.

Amid no economic releases in UK today, markets participants would look forward to global events for direction.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.